If you buy and sell different international currencies, then that is called Forex trading. Different countries’ central banks, governments, various business organizations, and individual traders need to pay for goods and services. When they pay local money converted to other currencies, then they are actively involved in Forex trading. More simply, whenever you pay money to buy a product in a different than the local currency, then you also get involved in Forex trading. So Forex trading is exchanging local cash with a different currency.

Fx market, is the international market that allows any trader to trade two different currencies against each other. This is the world’s most traded, most liquid, and largest market. Here, different national currencies are traded, with a $ 7.5 trillion per day turnover. In this piece of content I will describe what is Forex market,how to trade Forex market and many other things regarding Forex trading. Keep reading!

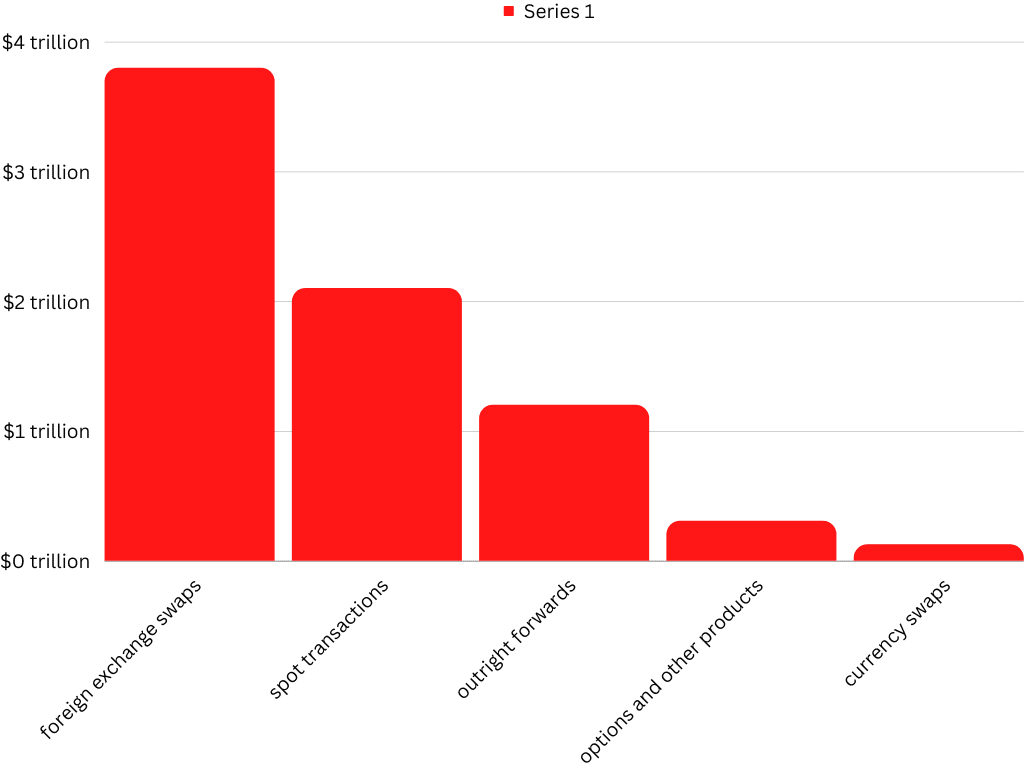

We already know that Forex market as big as 7.5 billion dollar. Now this whole amount is break-down in five major markets. $2.1 trillion in spot transactions, $1.2 trillion in outright forwards, $3.8 trillion in foreign exchange swaps, $124 billion or $0.124 trillion currency swaps, $304 billion or $0.304 trillion in options and other products

What is Forex market

The fx market Forex market is decentralized, and here exchange rates can be changed in the blink of an eye. Suppose you are travelling from England to Japan. Definitely, you will find a money exchange counter at the airport. Now all you have to do is exchange the pound you have in your pocket for Japanese yen while visiting Japan. When you do this, you will engage in the foreign exchange market. Do you know why? Because you are exchanging one currency for another, in this case, you are exchanging the pound to get Japanese yen.

Fx traders or currency speculators buy currencies, assuming that they will profit by selling them at a higher price. If you compare this market with the world’s largest stock market, the New York stock exchange(NYSE), then you will get shocked because the average daily trading volume of the NYSE is only 30 billion each day where the total volume of the fx market is more than 6 trillion per day. So if the NYSE market is big, then when it comes to the forex market, it looks like a baby. The forex market rarely closes. The stock market like NYSE, London stock exchange closes at the end of each business day, whereas the fx market does not close this way. The market is open 24 hours a day and five days a week. This market only closes during the weekend on Friday night and opens on Sunday at midnight.

28 major forex pairs list or recommended currency pairs for beginners

Top currency pairs

- AUD/USD

- EUR/USD

- GBP/USD

- USD/CAD

- USD/JPY

- USD/CHF

- AUD/CAD

- AUD/CHF

- AUD/JPY

Top currency pairs

- AUD/NZD

- CAD/CHF

- CAD/JPY

- CHF/JPY

- EUD/AUD

- NZD/USD

- NZD/JPY

- NZD/CHF

- NZD/CAD

- GBP/NZD

Top currency pairs

- GBP/JPY

- GBP/CHF

- GBP/CAD

- GBP/AUD

- EUR/NZD

- EUR/JPY

- EUR/GBP

- EUR/CAD

- EUR/CHF

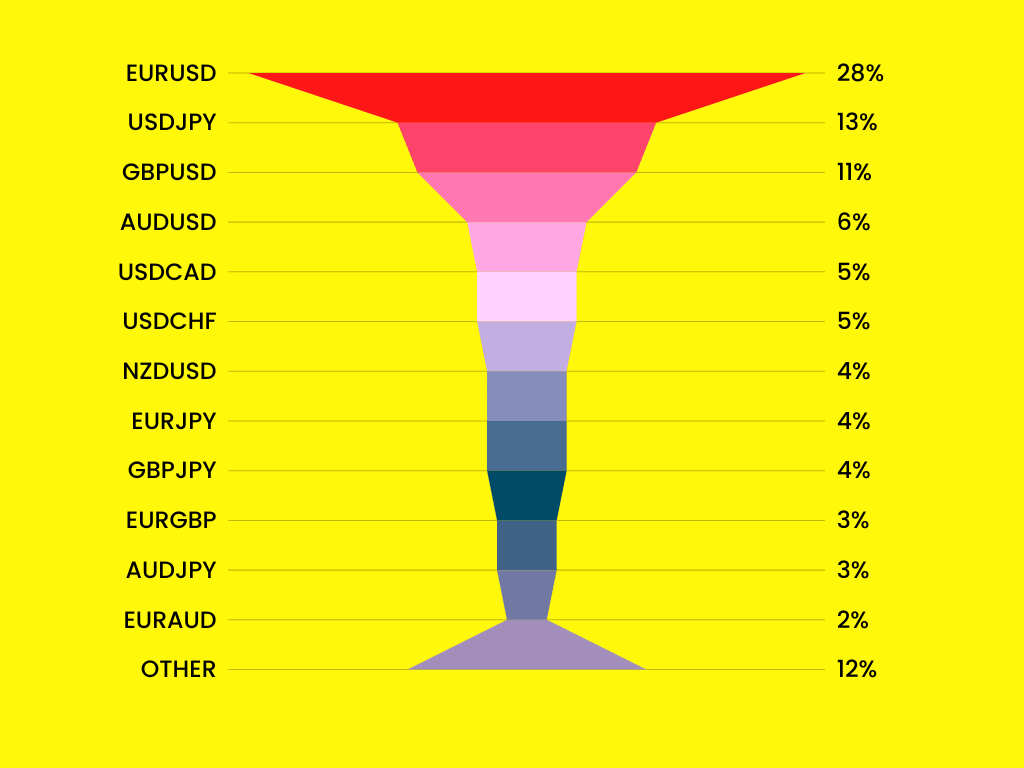

Among these 28 pairs, not all the pairs are traded equally. As a retail trader, you need only to trade a highly volatile and top-traded handful of currency pairs. If you trade all 28 pairs, then making money for us would be very difficult. Because then you need to analyze all these 28 pairs. You need to keep an eye on so many central banks’ monetary policies and so many geo-political issues. Better you keep trading only a handful of the most volatile few pairs. The list is below.

Forex Market size and liquidity

The forex market is huge. From the daily trading volume of the 7 trillion dollars market, 2 trillion dollars are traded in the spot market, and the rest 5 trillion dollars are traded in other derivatives. Geographically London is the biggest fx trading hub. Fx trading in the united kingdom marked more than 40%.And the rest 60% are traded all over the world. Thus the United kingdom has become the most crucial foreign exchange center in the whole world. Trading in the USA accounted for 16%, Japan marked 5%, and hong kong accounts for 8%

Forex Market participants

Although there are so many participants, not all of them are noteworthy. Smaller banks, Retail market makers, Big multinational corporations & commercial companies, Big multinational corporations & commercial companies, Gigantic hedge funds, Insurance companies, Hefty mutual funds, Central banks, Pension funds, Investment management firms, Brokerage firms, And other institutional investors are the major market participants of forex.

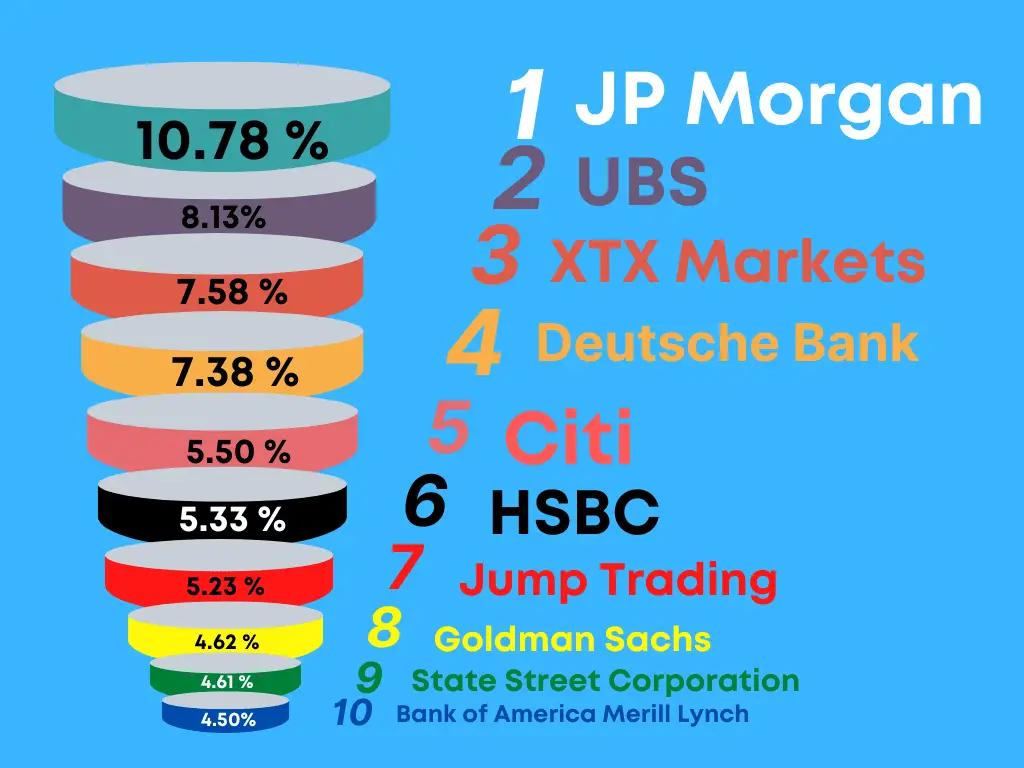

Name of top 10 currency traders

You already know who are the major forex market participants. Don’t you get curious to know who the leading currency traders are? I am going to give you the exact names of the currency traders. Yes, these are the big boys of the forex market. JP Morgan, UBS, XTX Markets, Deutsche Bank, Citi, HSBC, Jump Trading, Goldman Sachs, State Street Corporation, Bank of America Merrill Lynch are the top ten currency traders in the forex market.

Forex for hedging

The foreign exchange market gives you the benefit of both buying and selling the same currency pairs at the same price. You can buy and sell at the current price or fix a future price in which your fixed currency pairs will be bought or sold.

For example, your EUR/USD pair’s current market price is 1.1250. You place both buy and sell orders at this price. You put 25 pips stop loss, and 50 pips take profit. The next day the price goes to 1.1300. your sell order will be closed at 1.1275, and your buy order will hit take profit at 1.1300.you will get 25 pips profit. If you opened both trades at 1.00 lot in a standard forex trading account, you would make 2500 dollars.

Forex for currency pairs Speculation

Trade flows, geographical conditions, economic stability or instability, interest rates, and other factors directly affect the market or, more specifically supply and demand chain of the market. If a currency’s value increases against other currencies and any speculator buys that currency, he will profit. And if a currency’s value decreases against other currencies and any speculator buys that currency, he will lose money.

Remember, as currencies are traded as pairs, forecasting one specific currency of the pair will be strong is the same as predicting that the other pair’s currency will be weak. Suppose you forecast that the interests rate of the USA will rise compared to the kiwi dollar. And the present exchange rate of NZD/USD is 0.81.

Which means you need $0.81 US dollar to get one kiwi dollar you thought that higher interests of U.S. will increase demand for USD and, therefore, the rate of NZD/USD will go down. If your forecast goes right and the interest rate of the U.S. goes high. The output is NZD/USD exchange rate goes down to 0.50. which means it requires $ 0.50 USD to buy one kiwi dollar.

If you sold the kiwi dollar against USD, your trade would now remain in profit. Thus by speculating the market, you made a profit.

Charts Used in Forex Trading

In forex trading, we find three types of charts.

- Candlesticks charts

- Line charts

- Bar charts

Pros and Cons of Trading Forex

Pros of forex trading

- Forex market is the biggest market in the world

- They trade 24/7 and offer lots of liquidity.

- Forex trading allows individual traders and retail traders to make money quickly with little investment.

- Automated trading makes it easy to execute forex trades.

- Leverage allows you to trade larger amounts of currency with less cash.

Cons of forex trading

- Forex trades are extremely risky because of the extreme levels of leverage used.

- Currency traders must understand economics and how different countries interact.

- The forex market lacks regulations because there is no central authority.

There are three types of forex market-where is Forex traded

Currencies are traded through these three mediums.

- Forward Forex Market:A contract is an agreement to buy or sell a specific amount of a currency at some point in the future.

- Spot forex market:Derivative contracts are used to hedge against fluctuations in the value of a currency.

- Future forex market:An exchange-traded fund is a type of mutual fund that trades on stock exchanges.

Types of forex pairs

There are four types of forex pairs in the market.

- Major pairs – example: EUR/USD, USD/JPY, GBP/USD, and USD/CHF

- Minor pairs – example: EUR/GBP, EUR/CHF, GBP/JPY

- Exotics pairs- example: USD/PLN, GBP/MXN, EUR/CZK

- Regional pairs -example: EUR/NOK, AUD/NZD, AUD/SGD

What is leverage in forex trading?

Leverage lets you make large trades without putting up a lot of money upfront. Leverage is a two-edged sword. Leverage can multiply for profit as like as it can magnify your losses. So when using leverage, be careful.

Forex Trading Platforms

- mt4 platforms

- mt5 platforms

- c trader platforms

Is Forex profitable?

Of course, forex trading is profitable. if you trade based on some proven strategies like macd scalping strategy,34 ema wave strategy, two doji in a row stratgey,3 ducks trading system.These powerful but free trading systems are all available here in parkingpips education section.

Are forex markets regulated?

Foreign exchange trading is heavily regulated in many countries like the USA and UK.as. Forex traders use heavy leverage, so many developing countries like India, Pakistan, China impose restrictions on the farms to be used in foreign exchange. National Futures Association (NFA), Commodity Futures trading commission (CFTC), financial conduct authority ( FCA) monitor and regulate foreign exchange markets. That’s why top-level Forex brokers like FXCM, I.G. markets, I.C. markets get regulations from them. But unknown and ill-practiced online brokers like Hankotrade don’t get regulations from these authoritative bodies.

Are forex markets volatile?

Forex markets are among some of the most liquid markets in the world. Imbalance in trading relationships with another currency, economic stability or instability, some other economic data, News from big companies and central banks, geopolitical conditions, political conditions, and economic conditions make the foreign exchange market volatile.

Top central banks and their role in the foreign exchange market

- U.S. Federal Reserve System (Fed)

- Bank of England (BOE)

- Bank of Japan (BOJ)

- European Central Bank (ECB)

- Swiss National Bank (SNB)

- Bank of Canada (BOC)

- Reserve Bank of Australia (RBA)

- Reserve Bank of New Zealand (RBNZ)

Central Banks control supply and demand. Quantitative Easing increases inflation and lowers the value of the dollar. Higher interest rates mean that investors have less money to invest. When interest rates rise, retail investors have less money to spend, making it difficult to buy goods and services.

Which moves the forex market?

Multiple factors affect the market, but in short, Forex is mostly driven by the forces of Supply and Demand. When supply and demand have a small gap, the market remains less volatile, but if there is a huge gap between supply and demand, the market goes crazy. If you want to know the core basics of the market and become a top-notch analyst, then you must have a deep understanding of supply and demand.

What is margin in forex trading?

Margin is the amount of money you must pay to open a position. Margins are an important part of leverage trading. Leverage is when you risk more than you are willing to lose. You can use leverage to increase your profits. Leverage allows traders to make larger forex trades without having to risk all of their money at once. You should always check your margin requirements before opening positions.

Generally, the margin is expressed as a percentage of the entire position. However, sometimes some brokers can allow you to trade with high leverage. Like you can risk $10000 depositing only $200. That means you need only a 2% margin here. What margin you will use will depend on your trade size and your selected broker.

What is a lot in forex trading?

Forex trading is done through standard lots, mini lots, and micro-lots. Where a standard lot is 100,000 units of currency, a mini lot is 10,000 units of currency. Micro lot is 1,000 units of currency.

Base currency and quote currency

Forex pairs are two currencies that exchange value. Currency prices are always quoted in pairs, not as individual currencies. The base currency is the currency you want to buy, and the quote currency or counter currency is the currency you’re selling. For example, if the current price of EUR/USD is 1.1300. Here EUR is the base currency, and USD is the quote currency. Here one Euro is worth 1.1300 Us dollars. If you buy EUR/USD pairs, that means you are buying Euro against the U.S. dollar.

Which currencies can I trade in the currency exchange market?

As a professional currency trader, you should always trade high liquidate major currencies like EUR/USD( European dollar vs. American dollar) or AUD/USD (Australian dollar vs. American Dollar)

Liquidity refers to how easy it is to buy and sell a currency pair. Liquidity is the ability to buy or sell a currency pair quickly and easily. As exotic currency pairs are less volatile, try to avoid these exotic currency pairs like USD/INR. Exotic currency pairs are pairs of two different currencies that aren’t normally used together. Exotic pairs are those that don’t trade in large lots. Super professional and company traders stick to 28 major currency pairs only.

What is a pip in forex trading?

Forex Pips are used to measure movement in Forex pairs. A pip represents a change in the 4th decimal place. The pip will be larger if the quote currency is listed at higher values than the base currency. If the quote is lower than the base, the pip will become smaller. For example, if the quote currency is GBP and the base currency is USD, a pip equals 0.0001. If the current exchange rate of GBP/USD is 1.1350 then a move from 1.1350 to 1.1351 would constitute a single pip.

What is the spread in forex trading?

You can make money by buying low and selling high in this liquid market. Spread refers to the difference between the two sides of a currency pair.The tighter the spread, the more likely you are to make money when you trade. Your broker may offer to buy for you at a specific price when you buy a currency pair. This is called the bid price. Your broker might also offer to sell for you at a certain price. This is known as the asking price. Your broker’s bid and ask prices are usually very close to each other. The difference between them is known as the bid-ask spread.

How do I get started with forex trading or How to Start Trading Forex?

Financial markets are investment markets based on foreign currencies. It’s similar to stock trading, but there are some differences. You must learn how currency markets work before you start trading.

You’ll learn how to trade currencies if you use a micro forex trading account. Micro accounts are smaller than regular accounts and don’t require much capital. Develop a strategy based on your personal finances and risk tolerance. Developing a trading strategy is important before beginning to trade electronic trading.

It’s important to know how much money you’re willing to lose. Beginners should always check their positions at the end of each day. Cultivate emotional equilibrium during the ups and downs of trading.

Open an online forex broker’s demo forex trading account. Practice at least six months if you get success then come into the real trading world. After that, open a live account and trade with your hard-earned money.

How to Learn Forex

After learning what is forex next Developing solid trading habits and learning new strategies are essential for forex traders or individual investors. Forex trading requires constant learning. You must prepare yourself for every day. Learn about the forex market. Learn how to read charts. Learn how to identify support and resistance levels. Learn how to develop a trading plan. Learn how to manage your emotions. Learn how to analyze news events. Free resources offered by parkingpips could be a great source for you if you wish to learn Forex properly.

Forex Trading For Beginners

Forex is the largest capital marketplace. Therefore, it is vital to understand the basics of forex trading before entering the market. Currency trading has become increasingly popular over the past few years. This trend shows no signs of slowing down anytime soon. If you have ever thought about entering the currency market, now might be the time to take action. parkingpips’ free contents teach any currency trader how to read charts and develop trading strategies. There are many strategies like “4 hour forex simple system“, “1 min macd scalping strategy“.Study these free materials and apply these systems in your day-to-day trading; as a beginner, you can also trade Forex successfully.Beginners always search for what is forex but don’t focus on practising in demo account.That’s the major problem.

Best Practices for Forex Trading

Successful forex traders have a trading plan. Without a plan, a trader may lose money. Any successful investor should practice these three things before entering any trade.

1. Risk vs. Reward – A forex trader must know his/her limits before taking any action.

2. Leverage – A forex trader should never use more leverage than he/she can afford to lose.

3. Timing – A forex trader should always wait until the market is most favorable for entry.

Forex trading is about taking calculated risks. You can learn how to trade Forex through books and online courses.

Basic Forex Trading Strategies

Long-term traders make bets on whether currencies will rise or fall. Short-term forex traders make bets on how fast currencies will move. Scalping involves buying and selling stocks or currency pairs quickly. Forex Traders use scalping strategies to make quick money. Day traders use technical analysis to make money. They try to sell at the bottom and buy at the top. Position trading is a method of investing that involves buying at a low currency prices and selling at a high currency prices. It’s a form of speculation.

Free Online Forex Trading Courses

Trading foreign exchange/CFDs involves significant risks. Before deciding to participate in foreign exchange trading, learn properly. Webinars allow traders to watch experts trade live and learn new techniques. There are many video tutorials on www.youtube.com, www.dailymotion.com. Renowned brokers like www.fxcm.com, www.igmarkets.com also have many valuable resources. But if you want to get everything under one roof, go to www.parkingpips.com. You will get every single topic from what is forex to advanced forex strategies covered here in detail.

If you still need more resources, then search www.google.com; what you need, you will get that. But before learning the basics, don’t get trapped by so-called scammers.

Professional trader’s opinion about forex trading

“Trading currencies can be risky and complex”

JAMES CHEN

A trader buys one currency and sells another, and the exchange rate constantly fluctuates based on supply and demand.

Anna-Louise Jackson

The foreign exchange market, or forex (FX) for short, is a decentralized market place that facilitates the buying and selling of different currencies

Richard Snow, James Stanley

Sources

- https://en.wikipedia.org/wiki/Foreign_exchange_market#:~:text=The%20foreign%20exchange%20market%20(Forex,at%20current%20or%20determined%20prices

- https://www.cnbc.com/2021/12/02/barclays-rbs-hsbc-credit-suisse-ubs-fined-for-forex-trading-cartel.html?&qsearchterm=what%20is%20forex%20trading

- https://www.bloomberg.com/professional/blog/foreign-exchange-pros-rushing-meet-mifid-ii-requirements/