When you buy or sell foreign currencies on the foreign exchange market, that is forex trading. Traders aim to profit from currency price fluctuations. It’s popular due to its potential high profits and accessibility. People worldwide can trade 24/5. Currency pairs like EUR/USD,GBP/USD are traded here.

First, choose a currency pair and decide if it’ll rise or fall. If you think it’ll rise, you buy (go long). If you think it will fall, you sell (go short). Profits come from correct predictions.

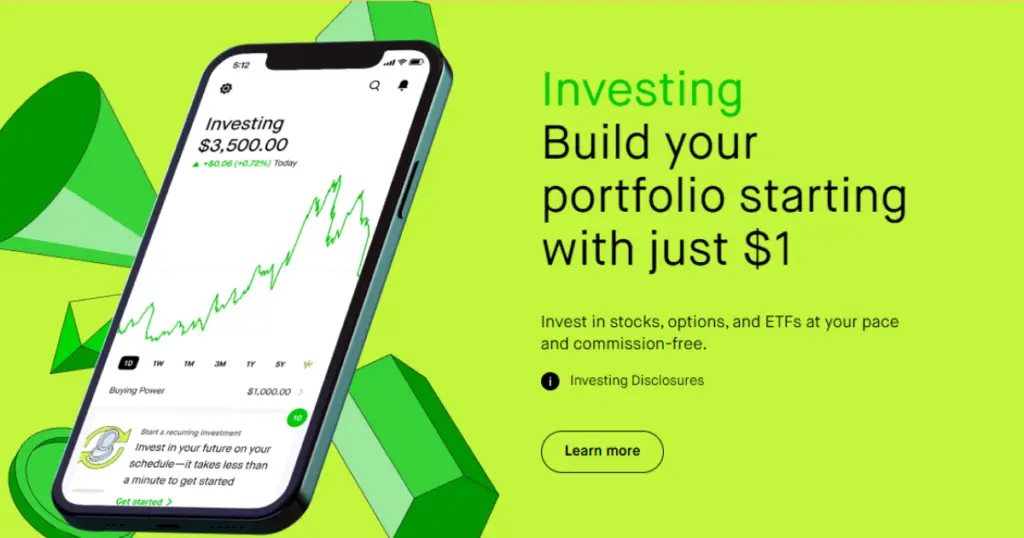

Exploring Robinhood as a Trading Platform

Robinhood’s user-friendly approach makes it a very popular trading platform. Professionals and newcomers can access and navigate the Robinhood trading platform easily. The platform gained recognition for its commission-free trading, attracting a large user base.

Initially, Robinhood focused on providing an accessible way for users to trade stocks without incurring commission fees. This approach disrupted the traditional brokerage model, making investing more accessible to a wider audience. The platform’s simplicity and intuitive interface appealed to many new to trading. This expansion broadened its appeal, catering to diverse investment preferences. However, it’s important to note that Robinhood’s simplicity and commission-free structure have occasionally attracted controversy and regulatory scrutiny.

But gradually, it expanded its offerings into options, cryptocurrencies, and exchange-traded funds (ETFs). Robinhood’s journey from a stock-focused trading platform to a multi-asset platform reflects its commitment to democratizing finance.

Can I trade forex on Robinhood?

At this moment Robinhood is not supporting forex trading. Robinhood primarily focuses on equities and cryptocurrencies, but forex trading is not within its offerings. Although you can’t trade forex on Robinhood, many forex brokers provide dedicated forex trading platforms.

Forex trading typically requires a specialized platform and broker catering to forex markets. These platforms provide tools and features for forex trading, such as real-time currency quotes, charting tools, and leverage options. Choosing a reputable forex broker that is regulated and offers a user-friendly interface is important.

Remember that trading forex involves significant risks due to the volatility of currency markets.

To become a forex trader, you must research and learn much about this market, build a solid trading system, and follow proper money management. Forex brokers offer many educational resources such as articles, video tutorials, etc. For practice, they provide demo accounts also.

Forex trading requires a dedicated forex broker

Forex trading necessitates the involvement of a dedicated forex broker. Unlike other financial markets, where you can trade assets through various brokerage platforms, the forex market operates differently due to its decentralized nature. Forex brokers act as an intermediary between traders and markets. It offers access to different currency pairs. It also helps to execute a trade.

These brokers provide trading platforms. And taking help of these platforms, you can analyze the market, place orders, and manage your trades. They offer various types of accounts, leverage options, and trading tools tailored to different traders’ needs. The forex broker’s role includes providing real-time price quotes, ensuring liquidity, and handling trade execution efficiently.

Choosing a trustworthy and reputable forex broker is crucial. Remember, your fund’s safe depends on how carefully and successfully you can pick a broker. Regulations, spread, fees, available currency pairs, customer support, and trading platforms are among the factors to consider when selecting a forex broker.

Some platforms that offer forex trading

- Meta Trader 4 (MT4)

- MetaTrader 5 (MT5)

- cTrader

- NinjaTrader

- Thinkorswim

Some popular forex brokers with a user-friendly interface

- eToro

- Plus500

- IG (IG Markets)

- TD Ameritrade (thinkorswim)

- Forex.com

Robinhood’s Crypto Offering and its Comparison to Forex

Robinhood offers a user-friendly platform for trading both cryptocurrencies and stocks. It’s important to note that although Robinhood will allow you to trade crypto like Ethereum or Bitcoin. But Robinhood does not offer forex trading.

Forex involves trading currency pairs in the foreign exchange market, whereas Robinhood’s crypto offering focuses on digital currencies.

Comparing Robinhood’s crypto offering to forex trading, there are differences in market structure, assets traded, and factors influencing prices. Crypto markets can be highly volatile. crypto world’s unique factors influence crypto market. On the other hand, forex markets are impacted by global economic events and geopolitical factors.

Both the crypto market and forex markets are risky for traders. So before investing in these financial markets, you need to develop a rock-solid strategy and follow proper money management while trading.

The Bottom Line

Although you can’t trade forex on the Robinhood platform, many platforms offer forex trading. If you are a stock trader or crypto trader, Robinhood is one of the best platforms.