There is nothing as simple yet confusing concept in market execution as using pending orders. There are known pending orders in investing, two of which are our main focus in this article, the Buy limit order and the buy stop order. Today I will also show you The buy limit buy stop difference.

Successful investors commonly hint at the importance of pending orders in trading as they can play a vital role in trade outcomes and success/loss ratios. Investors use pending orders to execute specific actions such as buying(long position), Selling(short position), stopping(stop loss) and taking(take profit).The latter(stop loss/take profit) falls in the category of closing trades.

Buy limit buy stop difference with a practical example of EURUSD

The difference between a Buy limit and a Buy stop depends on the price point in which the investor is looking to get into a long position. A Buy limit falls into the category of a limit order and is a pending order used when a trader is looking to open a long position at a specific price point below the current market price.

Let’s put this into practice, EUR/USD is at a price of 1.1391, the investor will then say if the price drops to 1.1280, I Will Then buy two Lot of EUR/USD

A Buy Stop is an order used when a trader wants to enter a long position at a specific price point above the current market price. A practical example of this trade instruction is: EUR/USD is trading at 1.1391. The investor will then call their broker and tell the broker to place a two lot of buy stop order at 1.1480 if the price continues to rise

The beauty of both of these pending orders is that they can be used in line with a multitude of different market conditions dependent and risk mitigation rules and strategies as traders/investors look to capitalise, giving an investor an edge to maximise their profitability whilst limiting exposure to losing.

Try to Understand the buy limit buy stop difference with the comparison table.

| Buy limit | Buy stop |

| Professional traders use Buy limit orders. | New forex traders use buy stop orders. |

| Higher chance to make profit | Little chance to make profit |

| You are buying from deep which means the odds are in your favour | You are buying from the peak. Thus odds are going against you. |

| The buy limit order is placed below the market price. | The buy stop order is placed above the market price |

| Perfect for both trendy and choppy markets | Perfect only on trendy markets |

When an investor can use a Buy limit or a Buy stop

Buy limit

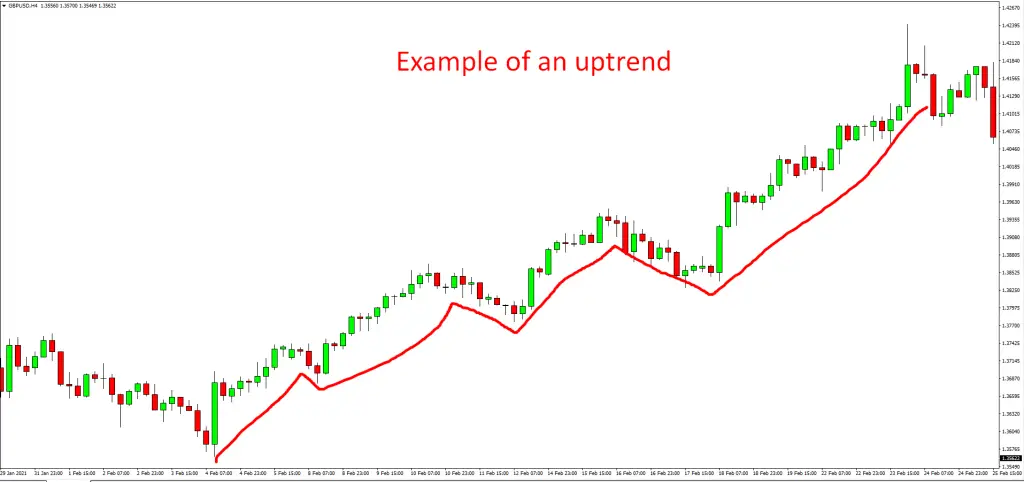

The optimal market condition to use a Buy limit is in a bullish market, where the market has a tendency of rising and then forming higher lows or when an investor is expecting a bearish market to reverse into a bullish market, then an investor will use a buy limit to try to catch the higher lows of the uptrend

Buy stop

The optimal market condition to use a buy stop is when an investor is expecting positive news releases on a certain stock or currency. Because when the positive news releases, the price will continue to rise more. So there is a high chance that the buy stop order will hit, and when the price goes further, that investor will make a profit.

Some other types of pending orders

There are other types of sophisticated pending orders which are commonly not offered by brokers, such as OCO order which stands for Order Cancels Order and common pending orders, such as the Sell Stop and sell limit.

Stop order

There is an important type of order which is known as the Stop order. The Stop order plays a vital role in risk management as it determines how much an investor is willing to lose if a trade goes against his position. This order type will be placed at a specific price point below the current price in a long position. And in a sell / short position, it will be placed above the current price point

Two major types of orders details

There are two types of forex orders: pending orders and market orders. And as we have discussed, you can find some of the pending orders. But there aren’t many options when it comes to market orders as this type of order is taken by an investor in real-time and at the current price point. However, many other conditions are to be followed before the trader can take a market order, or at least most professional traders follow certain protocols before executing a market order—some of which being market conditions, market sessions, risk/reward ratios etc

Order cancel order (OCO) details

Pivoting back to pending orders, the OCO order is one of the interesting types of pending orders. As OCO offers a flexible approach towards trade execution. Investors use this order to open two opposing pending orders using the Order Cancel Order instruction; then the broker will offer an option of closing one of the pending orders if the other is triggered;

a practical use case is: ABC Stock trading at $10 per share, an investor then sets a buy limit order of 100 shares of ABC stock at $8 per share then simultaneously sets a buy stop order at $12 per share and orders an OCO instruction to the broker, then if the price reaches $12 it will then trigger the Buy stop order and cancel the buy limit. On the other hand, if the price reaches $8 first, it will then trigger the buy limit and cancel the buy stop that is the concept of the OCO.

The disadvantages of limit and stop orders

There aren’t a lot of disadvantages when it comes to using limit orders because, unlike market order, if the price is not moving the way a trader was expecting as long as the order hasn’t been triggered, the trader has an option to cancel the order and reanalyse the market before making a trade decision.

Advantages, Why you should use a Buy stop/Buy limit

The idea of trading and investing is profit and freedom of time. Most investors do not have the time to stay on their screens because they have other businesses to tend to. And investing shouldn’t be time-consuming, so pending orders give you the ability to have trades executed without being around your trading terminal. It also gives you the advantage to enter markets when you are certain that they are going to give a strong bias towards the direction of your trade, and if not, then you have the stop loss to close the trade in case it goes against your position.

Why take profit and stop loss are also limit orders and the relationship between them

Limits play a huge role when developing a strategy; most, if not all, investors use limits one way or another.

Take profit

Take profit can also be considered a limit due to its functionality. When a trader/investor sets a take profit, they are technically telling the broker to close the trade once the price reaches a specific price. Taking profits is a traders way to secure profit and limit loss; therefore, it can be considered a limit.

Stop loss

A stop loss is another limit order because when you use a stop loss, you are technically informing the broker to close the trade if a trade moves against your trade and if it reaches a specific price point.

stop loss in a buy position always goes below the price point of your stop/buy limit Example of how a stop loss works, abc stock is priced at $33 a share, an investor opens a buy limit order for abc stock at a price of $25 and sets his stop loss at $22 a share; in this scenario, the investor wants the broker to open a long position if price drops to $25 and if the price doesn’t go up fro this point but instead continues to go down then when it reaches $22 he will loss $3 dollars per share that he had purchased, and then the trade will then be closed.

Risk management

Losses are an inevitable part of trading; however, one thing that separates a successful trader from a struggling one is risk management. Risk management forms part of the strategy part of trading. Here you can find that using pending orders can further enhance your risk management and increase your trade success ratio. As you enter moving markets or markets that have already formed a trend, it makes it much easier to approach the markets using pending orders, and remember we only use the buy limit/buy stop in an uptrend as an intermediate trader

How you would approach this is every time it has reached the middle of the formed a higher high and higher low, you would then enter a buy limit close to the peak low of the higher Low below the current price or enter a buy stop close to the higher high above the current price and then as a safety measure add a stop loss points below your pending order so that you do not expose your account to unexpected volatility. To touch on price action, one thing that has been analysed based on how markets act when they reach higher lows and higher highs, candles will begin to form. Wicks/spikes on the candles, and then you will have the rejection of price as further proof that you have reached a key level and may begin to execute your pending orders.

Use price action and other advanced methods if you want to get the best output from limit and stop orders

There are advanced approaches that you will come across as you evolve in the markets, such as using pending orders to catch trend reversals; I see this as an advanced approach because no one ever really knows when a trend reversal is on the horizon, however price action mixed with other confluences gives us a clue and is a good frame of reference as you can look through history and find a repetition of patterns.

I hope this information has covered the concepts of what entails the buy limit/ buy stop pending order and gives a broader perspective of how they are used by professional investors to make executions. The pictures attached can be used as a reference as to how you would use the pending orders in current market conditions and also how you would use the uptrend(higher high /higher Low) to enter pending orders and maximise trade potential.

Conclusion

As of today, I wrote only about buy limit buy stop difference, so I didn’t discuss some other advanced types of orders like stop limit order, stop loss order, sell limit order etc. I will try to cover these topics later in detail and in-depth. Till then, keep reading. Enjoy!