Many new comers confused themselves understanding Cup and handle pattern vs Double top pattern. While there is no complexity as cup and handle is a trend continuation pattern and double top is a trend reversal pattern.

Although both are chart pattern but one is continuation and the other is reversal. As I get too meany requests to discuss both of them so I am going to dissect Cup and handle pattern vs Double top pattern in this content.

Cup and handle pattern vs Double top pattern

| Cup and handle pattern | Double top pattern |

| Trend continuation pattern | Trend reversal pattern |

| Looks like a cup in what we drink tea or coffee! | Looks like english alphabet “M” |

| After cup and handle bullish breakout happens | after a double top pattern bears dominate the market |

| Traders find buy opportunities in a cup and handle pattern | Traders search selling opportunities in a double top pattern |

| In a cup and handle pattern you need two parts. one is cup and the orther is handle | In a double top pattern you need three parts. one is first top, the other is second top and the last one is neckline |

| Only professionals can properly identify cup and handle pattern but newbioes often find it problematic to detect the perfect cup and handle formation. | Both newbies and professionals find no problem at all to detect the double top pattern. As identifying this pattern is easy. |

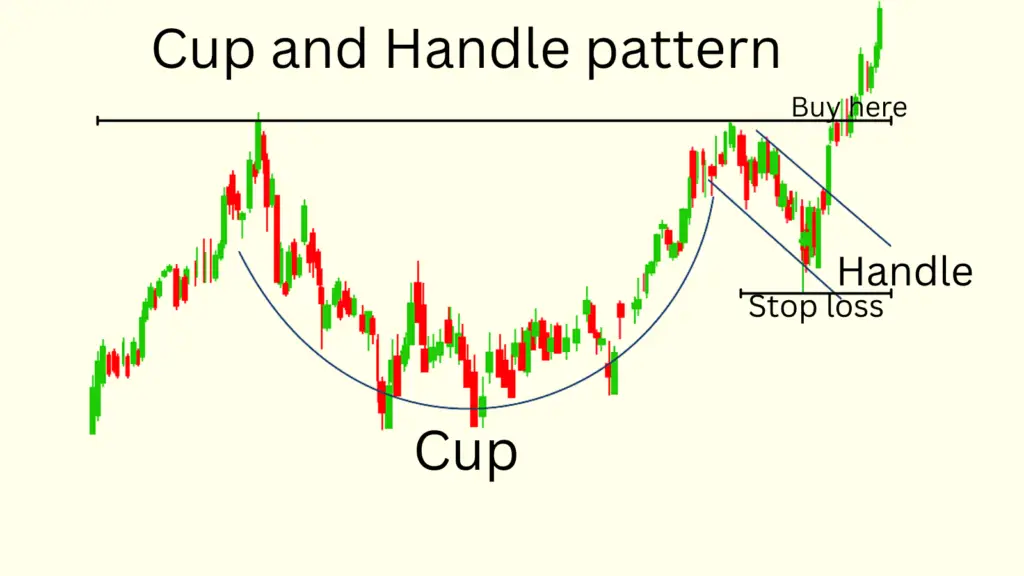

Cup and handle pattern

Cup and handle is a bullish continuation chart pattern just like other chart pattern. for example head and shoulder, Descending triangle,Symmetrical triangle and so many. Cup and handle happens ehen there is a consolidation in the market and afher cup and handle happens you can expect a bullish breakout in the market.

How many parts are there is a cup and handle pattern

There are two parts in a cup and handle pattern.

- The cup

- The handle

The cup : Just after a downtrend cup forms. Cup looks like a cup or round bowl. As it looks like a cup so traders calls the pattern cup and handle pattern.

The handle: When the formation of cup is completed then the price trades sideways. market gets choppy. As this ranging period is situated at the right side and this choppy period looks like handle so traders calls this part the handle of the cup.

How to trade using Cup and handle pattern

Remember the handle is always smaller than the cup. When the formation of handle is completes at the right side ofd the cup we call that period as cosolidation period. And when this consolidation is finished you can expect a bullish breakout is about to happen.

When the second part of the handles breaks the levels established by the cup we will open a buy trade. Your stop loss should be below the low of the handle. And your target would be as long as the cup’s bodys distance.

Double top pattern

If price hits any certain levels and then price retrace back. Then when price gets back to the same level and hits the level for the second time but can’t break the level than that formation is double top formation.

When you find these two tops one after another and bounce off from the same level then you can expect that a strong reversal is about to happen. This is why traders call this pattern a reversal pattern.

How to trade using a Double top pattern

When you find a perfect double top pattern then wait for the neckline break. If you trade just after seeing the double top then there is high chances that you will lose money. you need to patiently wait for the neckline break. when the neckline break happemns then you can confidently open a sell trade.

Your target should be at above the double top level. Your take profit would be the same distance of your neckline. I am giving here an live tarde example so you will be able to understand it better.