2 Doji candles in a row is a potent candlestick formation if you are a price-action lover. But, of course, we all know that any strategy is made of combined different technical indicators. But two doji in a row strategy is based on pure price action. No extra indicator is used here.

What does a doji candlestick mean?

For any candlestick, When open and close remains equal for any given period like 4-hour timeframe, daily timeframe, or weekly timeframe, then that is called a Doji candlestick. Doji candle is a trend reversal trading pattern. As we know, candlesticks charts were invented and developed by the Japanese, so,doji means blunder of mistakes in the Japanese language.

What does a doji candle indicate?

Doji candle indicates the indecision of the forex market. Buyers or sellers control the forex market, but when Doji candles are formed, we assume that neither bulls nor bears are in control. As there are five variations of doji patterns so This is very crucial to understand how these candles come about, what does doji candlestick indicate, and what does it mean for future price movements.

Trading rules of 2 doji candlestick in a row strategy

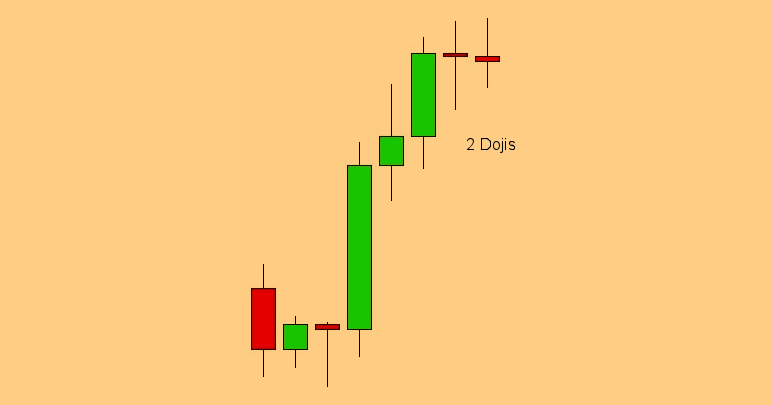

When you find 2 dojis in a row, there is a high probability of a strong move. If you are an intelligent trader, then you must partake in this move to make smart liquid money.

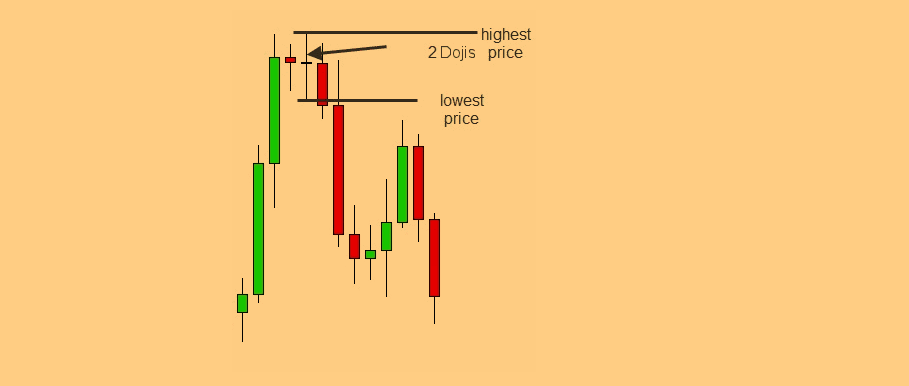

So first of all, in this strategy, you need to identify 2 dojis one after another. If you find 3 long-legged Doji candles in a row one after another after finishing a solid uptrend or downtrend, then that would be a bonus point for you.

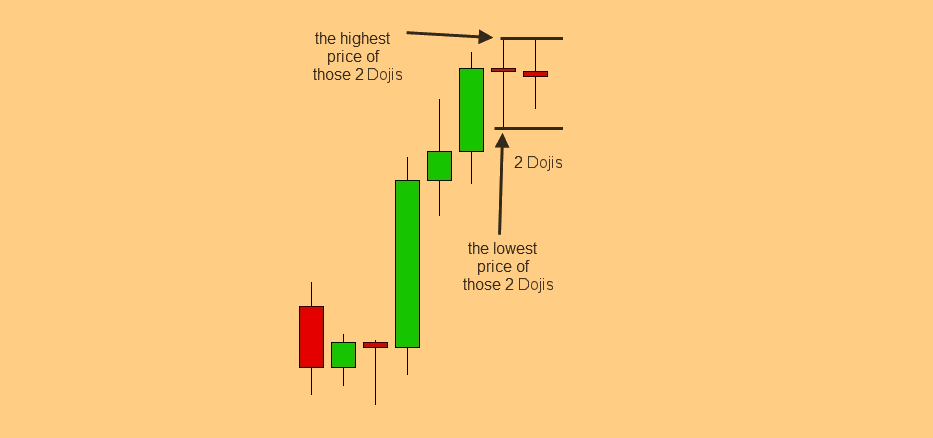

secondly, you have to mark the highs and lows of the two Doji. Thirdly, you need to open two positions at the same period of time. One is a “buy stop” order above three pips of the high point, and another is a “sell stop” order below three pips of the low end. If the market breaks the upper side, then your buy order will be triggered. And if markets break more downside, then your sell order will be activated.

Trade management method

Check what time do 4 hour candles close and always try to trade then. If you trade lower timeframe like 1 hour or 30 minutes, your chances of making a loss get higher. I recommend sticking with 4 hour and daily chart only.

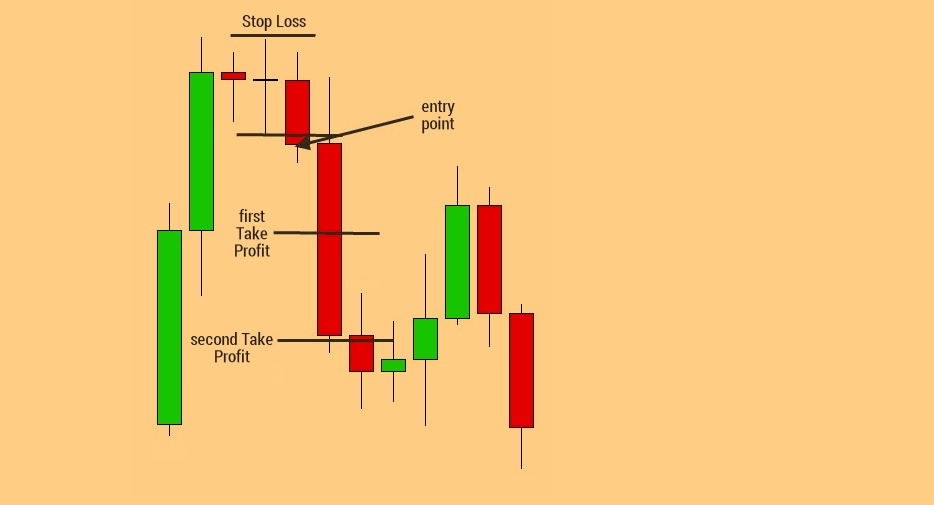

For long trade place stop loss below the dojis lower border For a short trade, place a stop loss below the dojis upper wall. Book your profit when your trade achieves a 50 pips profit targets. Don’t wait too long expecting too much profit.

Conclusion

In this article, I tried to explain what is a Doji candlestick pattern and how to read Doji candles. Traders who are doji patterns lovers will find this piece of content very helpful, and next time, if any trader finds 2 dojis in a row in any chart, he can apply this smart trading strategy.

If you can identify the setup correctly, this 2 Doji candles in a row forex strategy is a super powerful strategy.

Before investing your hard-earned money, first practice this strategy in a demo account. Then, when you feel confident about the 2 Doji candles in a row system, go for live trade and profit. Enjoy!