When you decide to open or close any transaction, then you need to send an offer to your trading platform, which is called “order”. As for entering and exiting trades perfectly, you need to know different kinds of orders, so today, we will discuss forex trading order types.

Forex trading order types details

Although different brokers have different kinds of orders, there are some basic types that all forex brokers accept.

- Market order: the very first and foremost order experienced traders come across is market orders. The name speaks itself. If any trader wishes to enter into the forex market immediately, he can place a market order and trade at the current rate. As in scalping and day trading, it is needed to enter and exit any trade quickly, so Scalper and day traders like to trade on market entry orders.

- Pending order: if you specify any price that will be executed at the subsequent period of time, it is called a pending order.

Forex trading order types

If you don’t care about the spread and plan to trade at the best available market price right now, then that is a market order. This is the most common and basic type of order. If you want to enter the market immediately, then go for a market order. For instance, the bid price of GBP/USD is 1.3444, and the current ask price is 1.3447.

If you plan to buy gbpusd at the market order, you have to buy this currency pair at 1.3447, which is the asking price. A market order is something like buying anything from an online super shop like Alibaba. You just go to their website and click online on what you need. That’s it. The product is yours. Like that way, you open your broker’s trading platform mt4,mt5, or c trader, then click buy, and your trading platform would instantly execute a buy order for you. Isn’t it easy?

Everything is similar except you buy Taylor swift music cd from amazon or eBay, but in forex trading, you buy currency pairs through your brokers trading platform.

Forex trading order types–Limit order

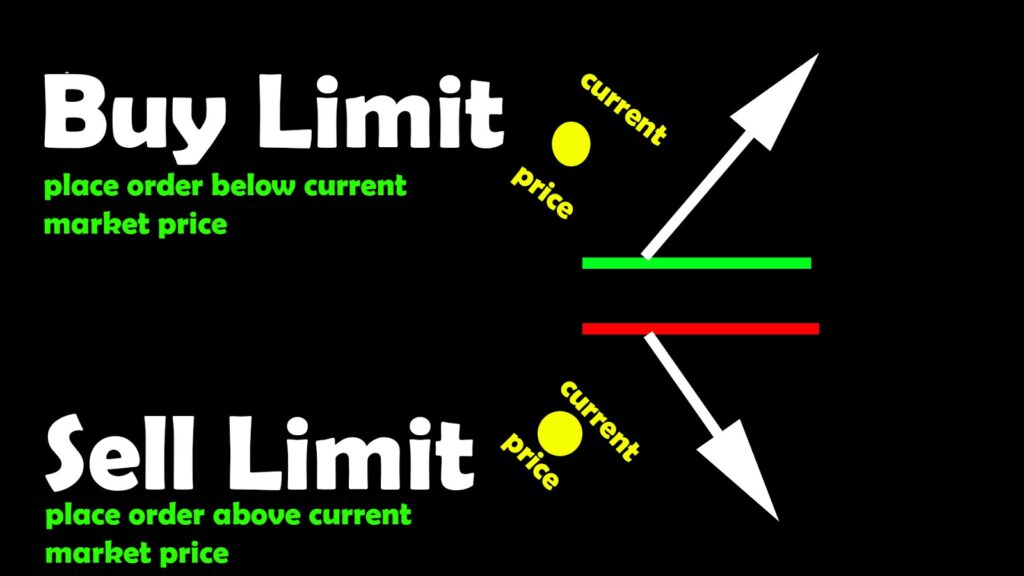

If you want the price to reach your desired price, and then your order will be executed, then choose the limit order. That means if you place a buy order below the market price and sell order above the market price, it is a limit entry order.

Your order will only be executed when the market reaches your desired limit price.

Buy limit order: place an order to buy below a specified price.

Sell limit order: place an order to sell above a specified price.

Check out the image below, and you will better understand the buy limit and sell limit.

Here in this image, the yellow circle is the current price level. Just notice the yellow circle here. The yellow circle is the current market price. The green line is situated below the current market price. If you want to place a buy limit order, then the price has to fall from the yellow circle to the green line or below it, then your order would be triggered. But you are placing the order now in the current market situation. Although you are placing the trade now as it will be activated in the future when the price moves to your desired zone, so it is a “buy limit” order. That means you are waiting for the opportunity to buy at a cheap rate.

Similarly, notice how the red line is above the yellow circle. As the yellow circle is the current market price, if you place a sell limit order, you have to set your price above the yellow circle, and when the price comes to your favourable price, only then will your order be executed.

In a nutshell, buy limit or sell limit order will only be executed when the price becomes more appreciative to traders.

Limit order example

For instance, the current price of gbpusd is 1.3452.but you don’t want to short it right now; instead, you want a more favourable price. You want the price to rise first, and when the market gets oversold, you will sell it. So you want the price first reached at 1.3482, and then your order triggered.

You have two options. You can either sit in front of your personal computer and eagerly wait for the price to reach 1.3482 and then enter the market instantly or simply place a sell limit order at 1.3482 and do your daily chores without any anxiety about the market. Just place the order to hang out with friends and family members!

When gbpusd reaches 1.3482, your trading platform will automatically execute the order.

Forex trading order types–Stop entry order

Stop entry order stops the order from executing until the order hits the price you set.

If you want to buy if and only if the price rises first and reaches a certain level, then place a buy stop order at that specific price level.

If you want the price to first fall like hell and then sell, then place a sell stop order below the current market price at your desired price zone.

In a nutshell, a buy-stop order is placed above the current market price.

And the sell stop order is placed below the current market price.

Look at the image below; you will better understand how the “buy stop” order and “sell stop” order works.

Here in this picture, the white circle is the current market price. Here the green line is above the current market price, and the black line is below the current market price.

If you place a buy stop order in the green line, the price must first rise from the white circle to the green line, and then your order will be triggered.

If you place a sell stop order in the black line below the white circle or current market price, then first, the price has to fall, and then your order will be triggered.

Stop entry order live example

The present quote of eur usd is 1.2138. Suppose you have a strong feeling that the price will decline more.

You place a sell stop order at 1.2113. if your order triggers and the price falls more, then you take your profit at 1.2083. here you make 30 pips profit.

But if you don’t know about the stop order, then you have to sit in front of the computer and wait for the price to fall first, and when you get your desired price, then you have to place a sell order at that current market price promptly. So think about how the “stop” entry order makes all these things easy for you.

How to place a stop loss order

Stop-loss order is the order which is placed to prevent additional losses.

Suppose if your trade goes against you, then for cutting huge losses, you can set stop-loss order.

If you are already in a buy position and making a loss, then place a sell stop order to avoid additional loss.

If you are already in a short position and making a loss, then to avoid additional loss, place a buy stop order.

Stop loss order live example

If you buy nzdusd at 0.7107 .as, you won’t make the right decision always as the market is king here. So you don’t want to blow your whole account in a single trade. For that very reason, you set your stop-loss order at 0.7060. It means if you prove yourself wrong, then and nzdusd drops to 0.7060 instead of rising upwards, then your trading platform or broker will automatically perform a sell order at 0.7060, and with a 47 pips loss, close out your trade.

It is excruciating for any trader when any trade hit Stop loss. But it is undoubtedly true that stop-loss orders are beneficial if you don’t want to stare at your mobile screen all the time or sit in front of your computer worrying you will lose all your money.

Just place a stop-loss order in any running trade, and then enjoy the world out of your successful trading.

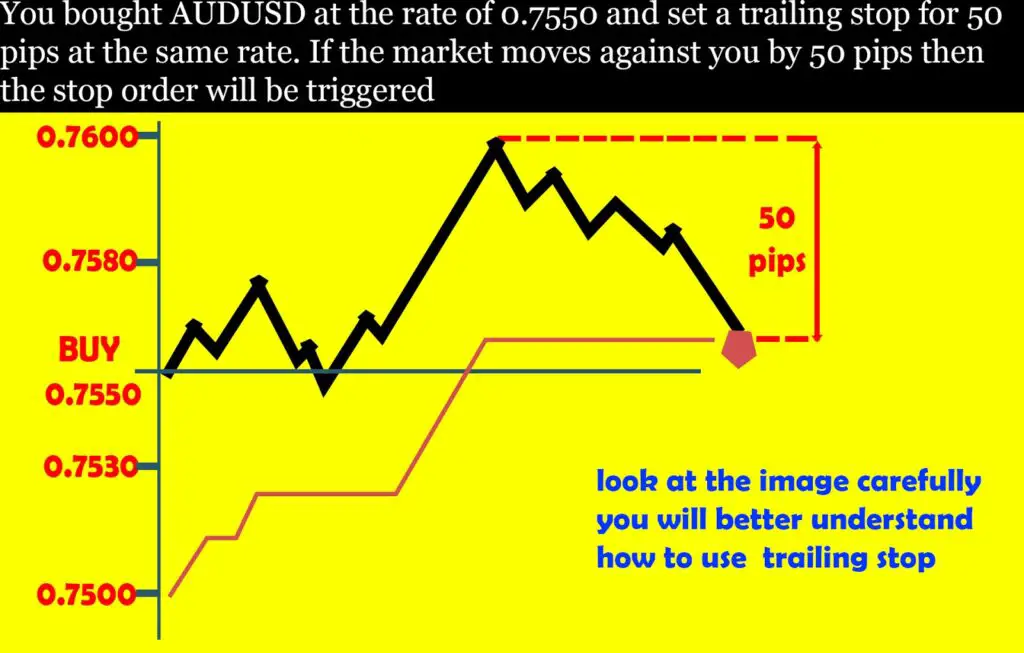

What is a trailing stop ?

When you set your stop order based on a predefined number of pips away from the current price, that is called a trailing stop order. This type of order will automatically trail any trade when the market moves in the trader’s favour

If the price fluctuates trailing stop order will also move with its attached trade.

Let’s say that you want to long audusd at the rate of 0.7550 with a trailing stop of 50 pips.

It actually means that your stop loss is at 0.7500.Suppose your analysis goes right and the price rise to 0.7600, then your trailing stop would move to breakeven point or 0.7550

Now the question is how you make a profit with it. Suppose your trade goes up another 50 pips at 0.7650. Now your new stop would be 0.7600. Here your stop will lock with 50 pips profit, and in this way, you can scale up your trade and maximize your profit according to the new market conditions.

Then when will your trade close? Your trade will remain open until it goes against your 50 pips. When the market moves against you with a 50 pips movement, then your trade will automatically close.

What are limit orders vs stop orders

If you are a newcomer at the forex market, then you may already get confused about the terms of stop orders and limit orders.

Let’s get started and remove all of your confusion. When you are telling your brokers at which price you would love to trade in the future, that’s called limit order and stop order.

It doesn’t matter whether it is a limit order or a stop order. Both types of orders are future orders.

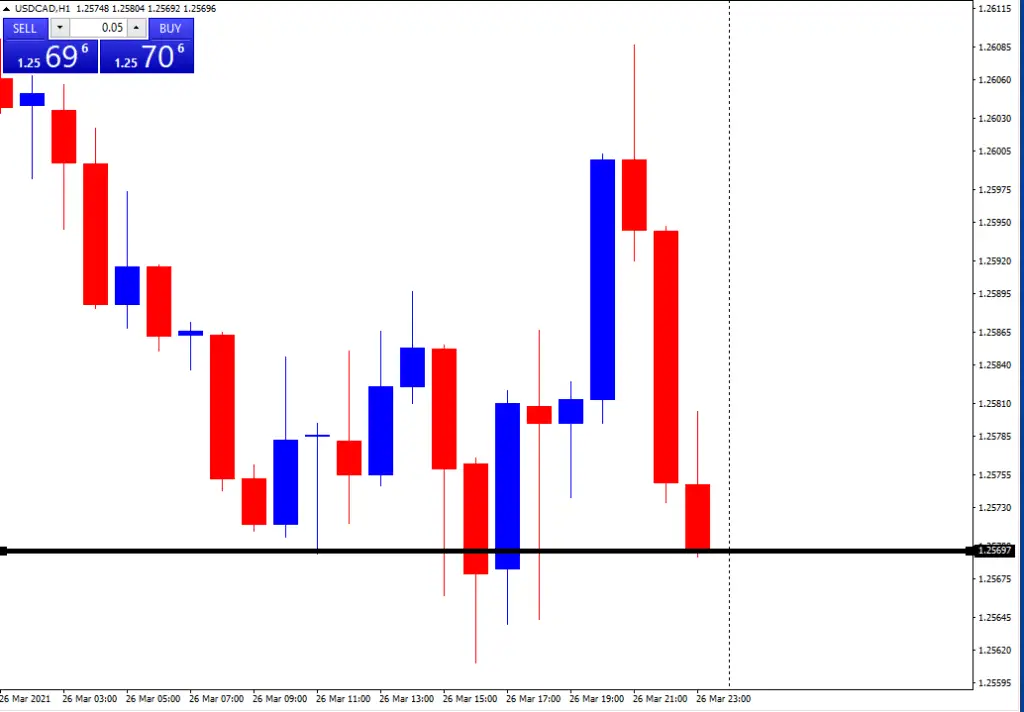

For example, if you wish to buy USD CAD . and the current market price of USD CAD is

If you think you will buy 1.2569

But you analyzed the market and came to a decision that the market will go down more, so you don’t want to enter the market at the current price, right now you just put a buy limit order at the price level 1.2500. When the market comes to 1.2500, then your order will be triggered. Thus by placing a limit order, you just get in the market for a better price.

Simultaneously if you think that the market is in a bearish mode right now, but if the market breaks the level 1.2600, then it will rise more, so you place a buy stop order at 1.2600, which is above the current market price.

If the market breaks 1.2600, then your buy stop order will be triggered, and you will enter the market. Although this way, you will enter the market at a worse price than the current market price, if your analysis is correct, then eventually you will make a profit.

This is the basic difference between limit and stop.

Futures order types and futures Forex orders explained

There are some future forex orders also.

Good till cancelled, or GTC is one of them. Your broker will not close this type of order automatically; rather, you have to. So you have to be very cautious about this type of order. When you decide to close this type of order, then your broker will close the goods till cancelled or GTC orders. As GTC order is fully your responsibility, so you have to be conscious that you have a GTC order scheduled.

Good for the Day (GFD) order

Such types of forex orders remain active until the end of each trading day. That means if you have any GFD orders, they will be automatically invalid after midnight when the US session closes. If you want to open another gfd order, then you will have to do it again when the new trading day begins.

Common types of One cancels other

When you place two orders at the same time, one is above the current market price, and another is below the current market price that is OCO, or one cancels the other order.

In this type of trade, one order will be placed, and the other will be cancelled automatically. This type of trading is very popular with professional traders.

To make it more clear, I am giving you real trading examples.

Suppose the current market price of gbpusd is 1.3789

You place a buy stop order at 1.3800 and sell stop order at 1.3700

If the price rises more and touches 1.3800, then your buy stop order will be executed, and your sell stop order will be cancelled. That’s why it is called one cancels the other.

Limit order trading strategy

Suppose you are planning to trade on a usdcad pair. The current market price of USD cad is 1.2596. Your analysis is telling you that this pair will rise again. So you plan to buy loonies against the US dollar. You place a buy limit order at 1.2564 as the support line for this week. So how could you find 1.2564 areas? For that very reason, you need to install a common indicator named standard pivot point. Just take a look at how beautiful the trade price reached that support line, and after touching that line, the price started to rise again. If you placed a buy order here and placed a take profit at the pivot point, which is the green line here, then you could have booked a handsome amount of profit.

With this rock-solid strategy, you can place a limit order at any pair. Remember to choose a limit order; you are just ensuring that you want to trade with a better price. Don’t jump on any trade at a current market price without analyzing the market properly. Rather stick to with this pivot point limit strategy, you will be a profitable trader in a long run

Final word

These are the common types of trading orders. Always remember placing a trade is not a hard task; even a monkey can trade. But the toughest part of this game is how wisely and beautifully you place a trade and manage it. So next time before placing a trade, try to understand your broker’s order entry system fully. Try to keep your ordering system simple if you want to be a professional trader. For becoming a professional trader you must need to understand Forex trading order types very clearly. I hope this piece of content help you!

What professional traders say about forex trading order types

“Basically there are 4 types of orders that retail day traders will use”

Jasper Lawler

“Market order is that you want to enter the market at the current price”

Rayner Teo

” A stop loss order is the reverse of a profit booking order”

Prachi Juneja

” If you’re going to be away from your trading platform for a long period of time, make sure pending orders are cancelled”

Cory Mitchell

“A limit order allows an investor to set the minimum or maximum price at which they would like to buy or sell”

KESAVAN BALASUBRAMANIAM

” It’s almost impossible to monitor the market every second, so that an entry order can be handy”

John Russell