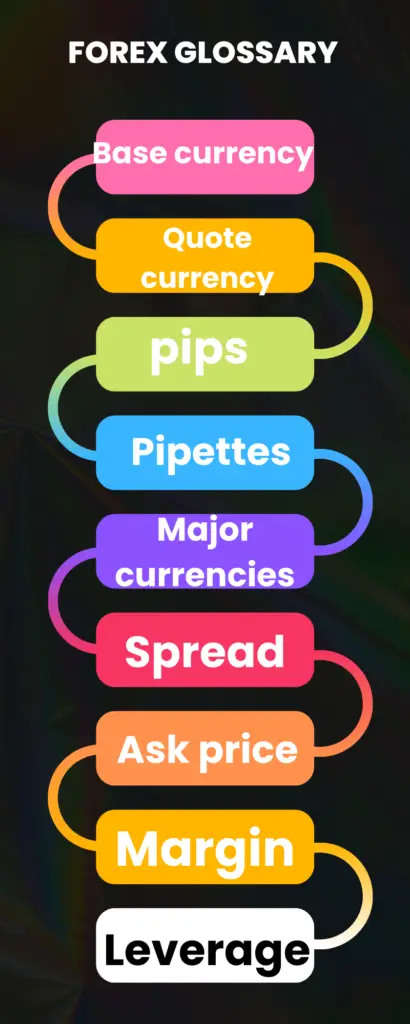

If you want to acquire knowledge on the fx market and become a successful trader then you must know the basic terms in forex trading. As a newbie if you don’t know the certain glossaries in any field from the very beginning of your learning period then you must fail today or tomorrow. So today, I will narrate the very basic terms in forex trading like base currency, quote currency, pips, pipettes, major currencies, minor currencies, exotic currencies, spread, ask price, bid price, margin, leverage, and many more.

What is the base currency in forex?

We all know in the forex trading platform, currencies are quoted in pairs. The base currency is the first currency in the quote, and the worth of the base currency is measured against the quote currency. If usdjpy is quoted 104.53, then one USD is valuable to 104.03 Japanese yen.

What is the quote currency in forex?

The second currency in the currency quotation is the quote currency. In the example above, jpy is the quote currency, and the unrealized profit or loss is shown in the quote currency.

In forex, what is a pip?

In the fx market, the tiniest unit of price value for any particular currency is called pip. For example, the present quote of audusd is now 0.7338. Here pips is the smallest change in the fourth decimal place. That means 0.0001.

Although most of the currency pip value is the fourth decimal place, the Japanese yen-related pair pip will be the second decimal place. Like in eurjpy present quote is 124.05. So here one pip equal to 0.01

How to calculate pipette forex

Basically, a pipette is one-tenth of a pip. For example, if the current price of gbpusd is 1.33294. and if it rises to 1.33296, then we call it moves two pipettes.

What is the bid price in forex?

In the foreign exchange market, at which the price forex brokers are ready to buy from you is called the bid price. If you see any forex mt4 or mt5 chart, you may notice that the price quotation is shown in two prices one is bid, and the other is ask.

For example, if today’s nzdusd price quote is 0.6975/0.6976. Then 0.6975 is the bid price, in this bid price, you can sell this pair to the market.

What is ask price in forex

in the foreign exchange market, at what price forex brokers are ready to sell any currency to you is called the asking price. At the asking price, you can buy the currency pair, more precisely, the base currency of the couple. the example shown above presents the cost of nzdusd is 0.6975/0.6976 here; 0.6976 is the asking price This means you can buy one kiwi dollar for giving 0.6976 USD dollars.

What is spread in forex market?

The divergence between the bid price and ask price is called the spread. For example, if today’s GBP/JPY quote is 139.33/139.36 Here the spread would be 3 pips.

What is margin in forex trading

If you prepare for a couple of months in a demo account and feel confident, try to open a live performance. You need to deposit a minimum amount of money to continue your trading activity in a live account. This minimum amount could be as low as 1000 dollars or as much as you wish to deposit.

But every period of time you place a new trade, then your broker separates a certain amount of money from your initial total capital and sets it aside as an initial margin requirement for your new trade.

And this certain amount that your broker separates from your principal capital is based on what currency pair you are trading, the price movements of that currency pair, the units of the lot you are trading.

For example, if you wish to open a buy trade on usdchf pair. You set leverage 1:100. That means you need (100/1)%=1 % margin. you are trading here in mini account in a mini lot where mini lot equal to 10,000$ So here, if you open one mini lot trade, then you need only =($10,000*1%)=$100

So your broker will separate that 100 dollars from your full 10,000 dollars as the initial margin of that particular trade.

What is leverage in forex trading

Leverage is the ability to rule significant amounts with small amounts of capital. It is the ratio of the amount of capital used to margin. Different brokers offer different types of leverage. From 1:1 to 1:2000, there are a variety of leverages. Some provide low quantity leverage, and some provide significant quantity leverage.

The major currencies

There are plenty of currencies used as a medium of transaction in the whole world. But in the forex market, we actively trade only a few of them. So the question is why all investors trade some currencies but not all currencies.

The reason is forex traders all over the world only love to trade economically, geopolitically stable currencies. This is why the US dollar is the most favorite currency of all professional traders. Look at the US economy. How gigantic it is and how strong it is. Claiming the name of the most liquid cash us dollar is the most actively traded currency in the currency markets.

There are eight major pairs or major currencies in the world.

Us dollar – USD

Canadian dollar- CAD

European zone currency- EUR

New Zealand dollar – NZD

Australian dollar – AUD

Japanese yen – JPY

Switzerland currency- CHF

Great British pound – GBP

CURRENCY PAIRS EXPLAINED

A quotation of two distinctive currencies is called currency pair, where the first one is the base and the second one is the quote currency. This quotation means you would have to pay the first currency to get the second one. For example, if you want to buy gbpusd at the exchange rate of 1.40 that means you are exchanging 1 pound and receiving 1.40 us dollars.

Seven major currency pairs

- EUR/USD – Euro/US Dollar

- USD/JPY – Euro/Japanese Yen

- GBP/USD – British pound/US dollar

- USD/CHF – US Dollar/Swiss Franc

- USD/CAD – Us Dollar/Canadian Dollar

- AUD/USD – Australian Dollar/US Dollar

- NZD/USD – New Zealand Dollar/US Dollar

Minor currencies

Minor currency pairs demand the second largest market share after the majors. As they are not as much as traded like major pairs so, in minor pairs, the liquidity is also low. As a result, the brokerage houses wide the spread in minor currency pairs.

Japanese yen, euro, and the great British pound (GBP) are the three most commonly traded currencies after the US dollar. So the currency pairs which are not paired with the US dollar but consist of these three currencies are called minor currency pairs.

The Most Traded Currency Pairs in the Forex

From 8 currencies, 27 currency pairs evolved. And from these 27 currency pairs, only 18 currency pairs are heavily traded. The majority of the forex trading volume involves these 18 pairs.

USD/CAD EUR/JPY

EUR/USD EUR/CHF

USD/CHF EUR/GBP

GBP/USD AUD/CAD

NZD/USD GBP/CHF

AUD/USD GBP/JPY

USD/JPY CHF/JPY

EUR/CAD AUD/JPY

EUR/AUD AUD/NZD

Exotic Currency Pairs

Emerging economies paired with major pairs are called exotic currency pairs.These exotic currency pairs are not as much traded as majors and minors because of low liquidity and high spread.

Below I am giving a list of some exotic currency pairs

- USD/HKD.

- USD/SGD

- USD/SEK

- EUR/TRY

How to trade forex pairs

Here I am giving some expert levels tips and tricks for trading currency pairs. As a beginner, you should always choose to trade most liquid currencies like EUR/USD, GBP/USD, USD/JPY.

At a beginner level, you won’t understand why the market moves and what moves the market, so try to understand the market fundamentals. Then try to learn some technical analysis. Always remember technical analysis is just the footprint of fundamental analysis. So technical and fundamental are just correlated with one another.

Always keep in mind that appropriate leverage is key to success in forex in many ways. Many newbies just wipe out from the market for choosing the wrong leverage. If you use excessive leverage, then your account is always at risk. Try to understand this term from the very beginning.

A trading strategy can help you out to become profitable from the loser. If you don’t have any rock-solid system, you trade here and there but not systematically; then you may make a profit in one or two trades. Still, your losing streak will be longer than your profit at the end of the month. Don’t try to follow anyone’s signal blindly or take any premium signal service if you don’t know why you placed a trade. Instead, make a plan to build a profitable strategy first then trade on a live account.

Many day traders & swing traders trade in various time frames. Those traders start from 1 minute and even trade on a weekly chart. Eventually, they don’t make money on trading. So always try to use the right time frame, and the time frame best suits your trading style.don’t listen to others about which timeframe is best; rather, find out the one which is perfect for you.

The final talk about the basic terms in forex trading

There are many technical and basic terms in forex trading, which I already stated above in detail.

As a trader, you should always read, learn, and grow your trading knowledge. When you apply this knowledge in real trading, your trading experience will boost. If you do so one day, you will also be a profitable trader; there is no doubt. Remember, who asks never knows the right answer.

Professional trader’s opinion about basic terms in forex trading

“There are some basic terms of the Forex market that all traders need to know “

Phillip Konchar

“The Forex market comes with its very own set of terms and jargon. These are forex glossary”

NIAL FULLER

sure why not ?

no i wouldn’t mind if you do so. i would love if you make a cooperation with me