Pip stands for percentage in point or price interest point. Pip speaks for a small measure of the shift in a currency pair like USD JPY, EUR USD. If you want to know all about pip, then the first thing you should know is what is a pip worth in forex trading.

Never ever go for live trading if you don’t know what is a pip value in forex trading and how to calculate pips ?

Pips education

A pip is the tiniest amount by which a currency quote shifts. It is a unit of measurement used in forex trading .pip is used to express the change in value Between two currencies. On a price quote, generally, a pip is the fourth decimal place.

Although most of the currency pairs are4 decimal places, there are some two decimal places also. Like GBP/JPY, EUR/JPY, etc., more precisely, yen pairs or jpy pairs are 2 decimal pairs.

So for yen pairs, pip is the second decimal place.

How to count pips with EUR USD and GBP JPY example

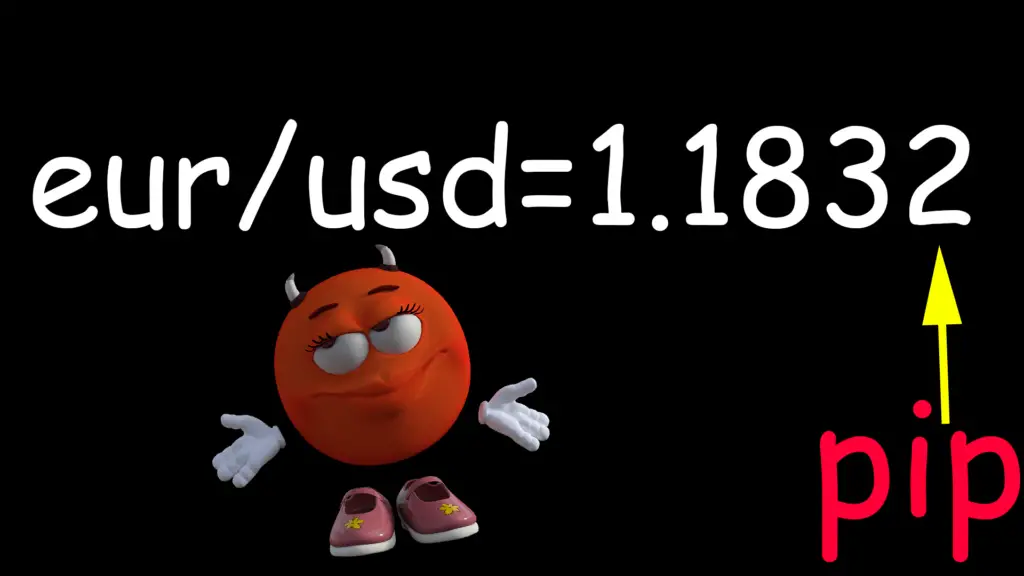

If EUR USD moves from 1.1832 to 1.1833, then that 0.0001 increase in value is one pip

If GBPJPY moves from 138.06 to 138.07, then that 0.01 increase in value is one pip.

Look at the picture below.

What is pipette used for

Although most forex brokers quote currency pairs on 4 and 2 decimal places, some brokers quote currency pairs on the standard of 5 and 3 decimal places.

These brokers quote currency on pipettes or fractional pips.

Basically, a pipette is equal to a tenth of a pip.

I know although the concept of pips is crystal clear to all but the idea of pipettes is confusing. That’s why I will now give you illustrations so that you will be more clear about this new term.

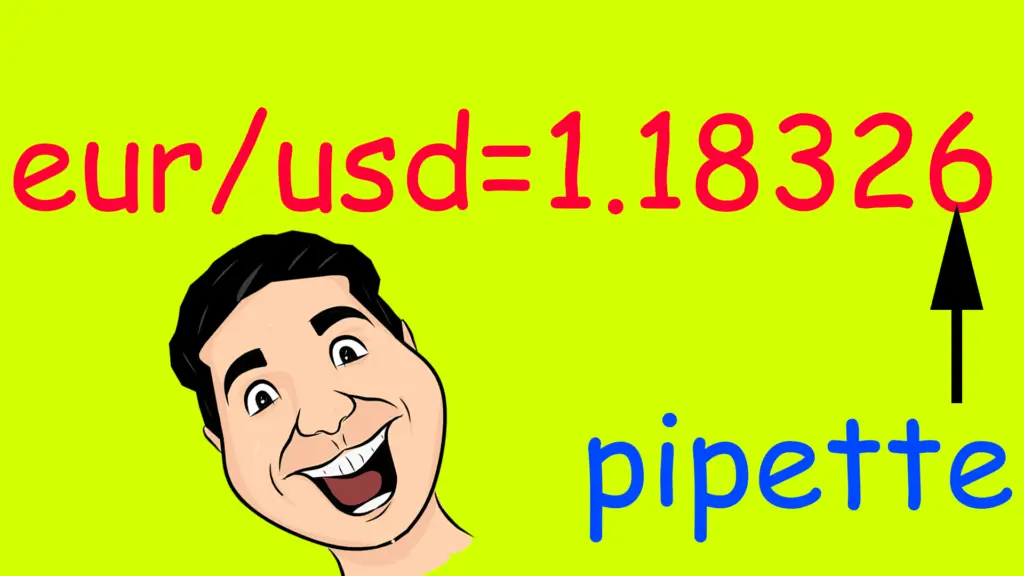

Suppose if EUR USD moves from 1.18325 to 1.18326, then that .00001 move higher is one pipette.

Look at the picture below. You will better understand

How much is 1 pip worth in forex trading with USD/CAD example?

Here in this example, I will use a USDCAD quote with 4 decimal places.

Suppose today’s USD/CAD quote is 1.3105

This means 1 USD to 1.3105 CAD

More precisely, 1 USD/1.3105 CAD

Or, [ 0.0001 CAD] × [ 1 USD/1.3105 CAD]

or, [(0.0001 CAD / ( 1.3105 CAD )] × 1 USD = 0.00007631 USD per unit traded.

If we trade 10000 units of USDCAD, then one pip change would be 10,000×0.00007631 USD = 0.7631 USD change.

What is a pip worth in forex trading – with EUR/JPY example

In this example base currency is EUR, and the counter currency is the Japanese yen or JPY

This is a 2 decimal place currency quote.

Suppose today’s EUR/JPY quote is 123.98

Here one pip shift would be 0.01 JPY

So the calculation would be like this

[0.01 JPY ] × [1 EUR /123.98 JPY]

Or, [(0.01 JPY )/ (123.98 JPY ) ] × 1 EUR= 0.0000807 EUR

If we wish to open 10,000 units of EUR JPY, then 1 pip shift is worth 0.807 EUR

What is a pip worth in forex trading – EUR/USD example

| Types of contracts | Size of contracts (units of the base currency) |

| Standard lot | 100,000 |

| Mini lot | 10,000 |

If we want to find out the value of one pip for the EUR/USD pair standard contracts, the calculation will be like this.

Pip value = contract size x one pip

Pip value =100,000 x 0.0001

Pip value = $10

If you place any buy trade on EUR/USD pair and the trade moves to your direction 1 pip, you will make 10 dollars. Every pip it goes against you, you will make 10 dollar loss.

If we want to find out the value of one pip for the EUR/USD pair mini contracts, then the calculation will be like this.

Pip value = contract size x one pip

Pip value =10,000 x 0.0001

Pip value = $1

Every pip the trade opened in a mini contract goes against you, you will make 1 dollar loss, and every pip the trade goes in your favor, you will make 1 dollar profit.

Pip value calculator forex

If you already get confused with so much data and maths and you think you need to become a math genius to understand pip value clearly, then you are wrong. Forex brokers made your work easy.

You don’t need to get frustrated if you don’t understand all those mathematical terms clearly. As they already add a forex pip value calculator, you just need to open the calculator and press the digit for knowing what is a pip worth in forex trading. The calculator will do all your mathematical work.

Isn’t it fantastic? The calculator is doing all your work. But I strongly suggest you understand the basics first. If you don’t know how to count pips manually and solely depend on calculators, then your calculation of forex knowledge would not be robust, and any time you could fall.

How to calculate forex profit and loss in pips

Changing in value of any particular currency pair determines whether an investor made a gain or loss. Suppose if an investor buys GBP/USD . and today’s GBPUSD quote is 1.3187. He will only make a profit if the pound rises in value relative to the USD. So if the investor buys the pound for 1.3187 and 2 days later closes the trade at 1.3287, he will make 1.3287-1.3187 = 100 pips profit in just two days.

Although the change looks tiny or 100 pips means nothing to you, as forex is a multi-million dollar business, many big boys are sitting in front of the desk trading with hundreds of millions of dollars.

Let me clear you with another example of USD JPY. Suppose any big bank buys Japanese yen by selling USD JPY at 104.62, and that bank closes the trade at 104.57.

If any big boy or big bank trades with a 10 million dollar amount, he will book 10 million* (104.62-104.57) = 500,000 jpy profit.

If you calculate this profit in us dollars, then the profit will be calculated as ¥500,000/104.57 = $4781.48

How many pips a day moves in most of the popular currency pairs

| Pair | Tokyo session | London session | New York session |

| EUR/USD | 77 | 113 | 93 |

| GBP/USD | 93 | 126 | 100 |

| USD/JPY | 52 | 65 | 60 |

| AUD/USD | 77 | 82 | 82 |

| NZD/USD | 63 | 73 | 71 |

| USD/CAD | 58 | 95 | 97 |

| USD/CHF | 68 | 101 | 82 |

| EUR/JPY | 103 | 128 | 106 |

| GBP/JPY | 119 | 150 | 131 |

| AUD/JPY | 99 | 106 | 102 |

| EUR/GBP | 79 | 60 | 48 |

| EUR/CHF | 80 | 108 | 85 |

Now you know what pip is, what does pip stands for, and What does the acronym pip stands for. But it is not enough for you to succeed in trading. You also need to know the average daily ranges of pips movement in forex .for doing that; you need to monitor your average daily range chart I have given adobe closely.

As most of the traders and investors like to trade yen(jpy), euro(eur)us dollar(USD), British pound(GBP), Canadian dollar (cad), new Zealand dollar ( nzd), Australian dollar (aus), so I give only range associated with these currencies.

100 pips a day forex strategy or 50 pips a day forex strategy?

Many new forex traders, even experienced traders who search for 100 pips a day forex strategy or 50 pips a day forex strategy. Today, I will show you one straightforward but effective method by which you can easily make 50 pips to 100 pips a day.

One thing to remember, although this system is surprisingly straightforward, the effectiveness of this strategy is incredible.

First, you need 3 mt4 indicators in your chart.

1)10 ema ( in my chart red color )

2)20 ema (in my chart green color)

3)Rsi 10

I use here 60 minutes time frame

Although you can use this simple but effective forex strategy in every currency pair, I strongly recommend using this strategy on only major currency pairs. Avoid exotic currency pairs to get rid of high spread and low movements.

When to buy

If relative strength index (rsi) cross-level 50 from below and

10 ema crosses the 20 ema from underneath place a buy order.

When to short

When rsi crosses level 50 from the top, and 10 ema crosses the 20 ema from the top, place a short order.

Although everyone should have their own trading plan, I recommend you to take profit at 50/100 pips.

Set your stop loss or s/l at least 100 pips.

Remember, your trading success depends on money management rules. So always try to follow strong money management rules. If you have capital in your trading account, then you will be able to trade, but if you blow all your balance in a single trade or a couple of trades, then when you get the perfect entry, you won’t be able to place that trade.

To protect your capital when your trade comes in your favor, always move your s/l at your entry point so that you can relax with your trade. When it makes a little profit, you set the trade, place it at break-even and forget everything.

This is what I call set and forget the forex strategy theory.

If you want to get 50 pips a day forex strategy or 100 pips a day forex strategy, this simple strategy can help you.

Conclusion

Forex currency pairs are quoted in pips. pips stand for percentage in points. In a nutshell, a pip is just one hundred of one percent, more precisely the fourth decimal place, which is 0.0001. we hear many times about bid prices, ask price, and spreads in forex trading.

All these terms are measured in pips. So what is a pip worth in forex trading is a significant factor you need to understand very clearly if you want to be a professional forex trader.

Professional trader’s opinion about forex pips

” “Pip” is an acronym for percentage in point”

Adam Hayes

” pips are needed to track price movements to a fine degree of accuracy”

Andrew Loo

” It’s important to note that the value of one pip will differ for different currency pairs”

Richard Snow

thanks

many many thanks to you

many many thanks