In the forex market, you buy or sell currencies. And the number of currency units you control here is called Lot. When we discuss “Lot”, the first question that comes to our mind is what is a lot size in forex.

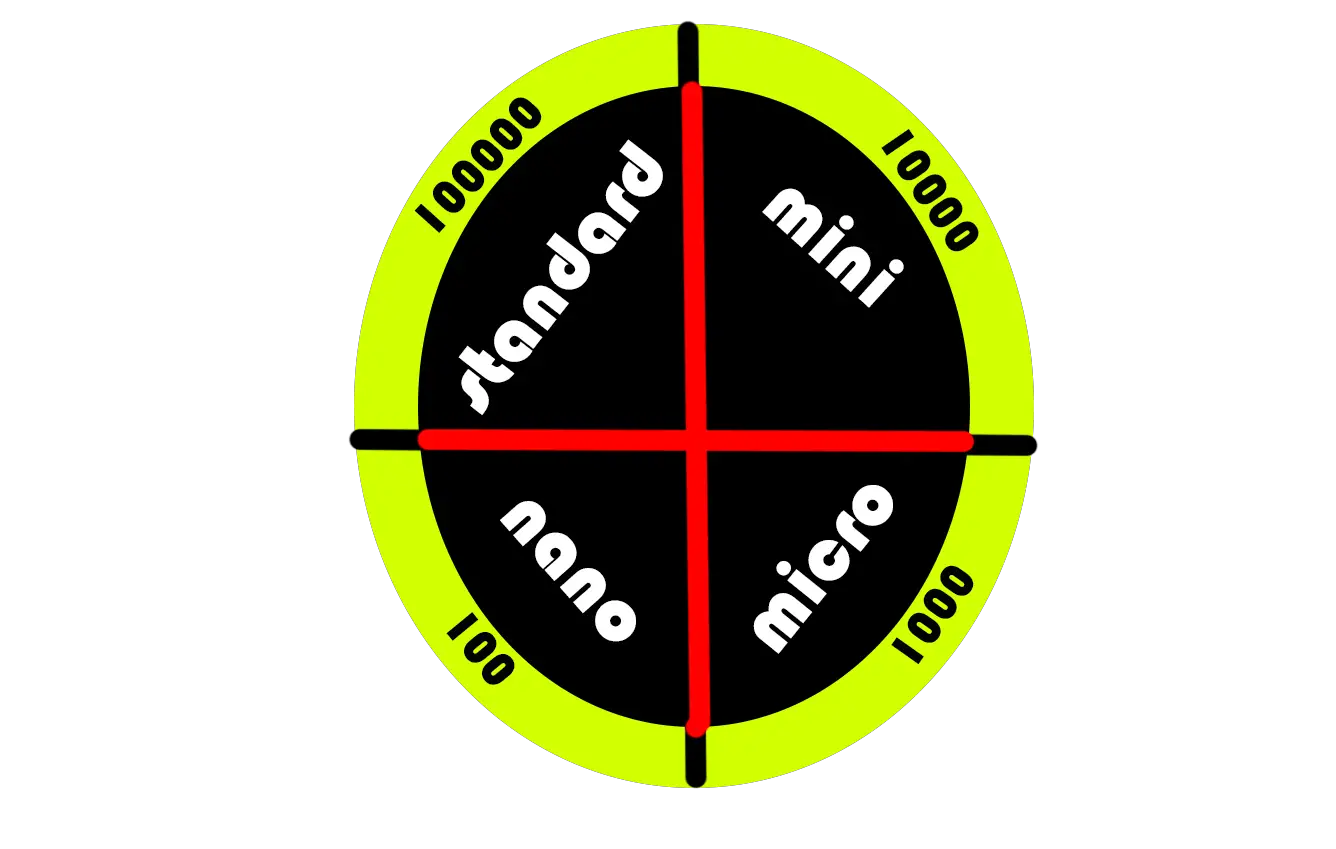

There are four types of lot sizes. If you want to understand the amount of risk size or how much risk you are taking, you need to understand lot size basics. Because lot size directly affects the level of risk you are taking in each trade.

| standard size | 100,000 |

| mini size | 10,000 |

| micro size | 1,000 |

| nano size | 100 |

What is a lot size in forex and how to use forex lot size calculator

Many find it problematic to calculate lot size and don’t understand which quantity of Lot one should use according to their capital. However, there is a smart solution to this problem.

Many Forex brokers and forex education websites give access to risk management calculators or forex lot size calculators. By using these calculators, you can easily calculate your desired position sizes without any hassles. To find the best lot size, if you take help from these tools, you could easily find your desired lot size.

It doesn’t matter whether you are trading on a live account or practicing your trading strategies on a demo account; always use a lot size calculator to determine your lot quantity.

Allow me to give you an example. So that you will better understand how to use the forex lot size calculator. Suppose if Eurusd moves 100 pips on the bullish side. These 100 pips currency movements will not affect the same as in standard lot size trade or in mini lot trade size.

So if your balance is low and you trade on a standard lot or high volume trade, then your balance will vanish, or you will blow your account even with a 100 pips movement. But if your account balance is low and you calculate your lot size in a Lot sizing calculator, then place a trade on mini lots, you will easily save your “balance” for the next trade. So lot size always matters in forex trading.

You already know the currency value measured in pips and pipettes. Pip is a tiny percentage of units of any currency’s value. To better understand the momentous profit or loss you should trade on a large number of units of any currency.

How to calculate pips and lots and the relationship between them

Suppose you are trading gbpusd. and you want to buy a standard lot of gbpusd at a current exchange rate of 1.3290 . So if the current rate rises then the calculation of your per pip profit will be like this. If the US dollar is the quote currency,

1) Gbpusd exchange rate = 1.3290

1 standard lot =100,000 unit of currency

Calculation = (0.0001/1.3290) x 100,000

=7.52×1.3290

= 9.99 or $10 per pip

2) Eurusd exchange rate = 1.1854

1 standard lot = 100,000 units

Calculation = (0.0001/1.1854) x 100,000

=8.44 x 1.1854

=$10 per pip

If us dollar is the base currency,

1) usd jpy exchange rate =103.83

1 standard lot =100,000 units

Calculation =(0.01 / 103.83) x 100,000

= $9.63 per pip

Usdchf exchange rate =0.9111

1 standard lot = 100,000 units

Calculation = (0.0001/0.9111) x 100,000

= 10.97 or $ 11 per pip

I think now you better understand What is a lot size in forex with a practical example

What is a lot size in forex – mini lot size

Forex mini lot would be a fantastic option for those who wish to trade with no leverage. Most of the top brokers offer this type of lot size in trading. Mini lot means 10,000 units of currency. Although the name itself is a mini lot, even this tiny amount is a prominent investment for many aspiring beginner traders who are still in the learning stage. If you funded a dollar-based account, then each pip equals $ 1.

If you are at beginner level and wish to start trading with a mini lot, then be sure you have enough money as a backup. Although 1 dollar per pip looks like a small amount in the foreign exchange market when the market moves against your favor then within 1 hour 100 pips movement is possible. And when the market goes against you, then this 100 pips means 100 dollars. You could lose this amount even in an hour.

How to make money trading micro Lots in forex

1,000 units comprise a micro lot. Most brokerage houses offer to trade in micro-lots, and it is the second tiniest lot available in the market. As most of the experienced forex traders and investors feel comfortable funding their account in US dollars so guess your account is also funded with US dollars.

So if your trading account is funded with US dollars, then a micro lot is 1,000 USD worth. That means you will be able to trade with this $1,000 base currency. Those who are new forex traders and want to taste money can choose micro-lots. Here one pip changes mean 10 cents changes. If you’re going to minimize your trading risk by lowering Lot size, then go for a micro lot.

what is a standard lot in forex?

If you ever get interested to know what is the highest lot size in forex trading or what is the biggest lot size in forex then here is your answer. Yes! The standard lot is the highest lot size in the financial markets.

A standard lot is 100,000 units of the base currency. The standard lot size is the most common lot size among the four types of lot size. One pip is equivalent to 10 dollars in standard lot size. Your account value will fluctuate by $10 in each pip change. That means you make 10 dollars profit in every pip that goes in your favor and you will lose 10 dollars in every pip move against you.

More precisely if you have 5000 us dollars in your account, then 50 pips movement against you could vanish 10% of your full trading account. This is the reason most retail traders and small investors don’t trade on a standard lot.

Perhaps it is not gorgeous to trade in a nano lot, mini lot, or micro-lot but if you don’t have a considerable amount of money then don’t place a trade on a standard lot. If you do so, then your capital will be safe, and if you learn to save your capital, then an opportunity will come when you place good trade and the market will be in your favor, and you would be able to make money.

If you ever get interested to know what is the highest lot size in forex trading or what is the biggest lot size in forex then here is your answer. Yes! The standard lot is the highest lot size in the financial markets.

A standard lot is 100,000 units of the base currency. The standard lot size is the most common lot size among the four types of lot size. One pip is equivalent to 10 dollars in standard lot size. Your account value will fluctuate by $10 in each pip change. That means you make 10 dollars profit in every pip that goes in your favor and you will lose 10 dollars in every pip move against you.

More precisely if you have 5000 us dollars in your account, then 50 pips movement against you could vanish 10% of your full trading account. This is the reason most retail traders and small investors don’t trade on a standard lot.

Perhaps it is not gorgeous to trade in a nano lot, mini lot, or micro-lot but if you don’t have a considerable amount of money then don’t place a trade on a standard lot. If you do so, then your capital will be safe, and if you learn to save your capital, then an opportunity will come when you place good trade and the market will be in your favor, and you would be able to make money.

Forex nano lots- 100 currency units

Nano lot is the smallest lot size available in the forex market. Nano lot consisted of 100 currency units. Although many unethical brokers do not offer nano lots, some retail broker provides this type of lot size to help poor traders and small traders. Those who are demo traders and wish to taste real money but don’t have enough capital chose this lot size. This would be an ideal lot size for those who try to trade live accounts for the first time.

Now, if any newbie asks you what is the lowest lot size in forex or for newbies what is the recommended lot size in forex, then very specifically suggest them to go for nano lots.

Best lot size to trade in forex

Now you know What is a lot size in forex trading. So the very next question that comes to your mind is what is the best lot size in forex. Many significant factors will determine which lot type best suits you. How much money do you have, how much risk do you want to take in every trade, what type of trader are you? These are the few among those factors.

Once you have fixed these criteria, then you should choose your ideal lot size. For example, if you are a wealthy trader and have enough money to trade, you are trading in forex for more than two years, have enough experience in real money trading then go for a standard account.

If you choose a top-class broker as your partner, who has rebate programs for their clients, then selecting a standard account would be the right decision for you.

If you are a conservative trader and don’t want to invest so much money in trading, have little experience in real money trading, then go for a mini account.

And last but not least types are nano and micro types. If you are a new trader, practicing on a demo account, wish to invest real money for the very first time then go for a micro account or nano account. The best lot size for $100 is nano lot.

What is a lot size in forex –What is 0.01 lot size in forex?

| Lot name | mt4/mt5 notation | Pip value |

| Standard lot | 1 lot | $10 |

| Mini lot | 0.10 lot | $1 |

| Micro lot | 0.01 lot | $ 0.1 |

Chart of lot types

What is a lot size in forex and what is leverage

After reading all this information about lot sizing, maybe you are getting disappointed by how a retail trader like you can place such a big Lot trade. How could you manage such a significant amount of money to get the real money taste?

Don’t worry! Leverage is here to help you out with this big problem. Brokerage houses offer you different types of leverage amounts. With this leverage, your broker will allow you to trade such a significant volume.

More precisely, if you consider your broker as a bank. This bank is giving you 100,000 dollars to buy currencies. To get the benefit of this service, you will have to provide only one thousand dollars as promised money. Yes! You read it right, but if you think your broker is helping you, then you are wrong. Your broker is not helping you, but the leverage is doing so.

If you are getting so excited about this beneficial feature of a broker, then be alert as there is a potential risk in using leverage. Margin is the initial capital you require to deposit in your broker. When you open a live account, you need to fix the amount of leverage you are comfortable with. There are many forex lot size calculators mt4 available online. Just go there and calculate these formulas with software.

What is a good leverage ratio for forex/ what is the best leverage in forex

1:50 is the good leverage ratio for forex. But if you are experienced enough then you can use 1:200 or 1:500. But for new traders, the only recommendation is to use not more than 1:50.

What is the best leverage for $100 or what leverage should i use forex

For trading with $100 use 1:500 leverage. As here capital is very little so you need to use high leverage like 1:500. But if your capital is more than 1000 dollars then use 1:200. This is the moderate leverage for all.

A practical example of what is a lot size in forex and what is leverage

You open an account depositing 5000 us dollars. You fix 1:100 leverage. 1:100 leverage means you need 1% of your position in every trade. Now you want to buy gbpusd worth $100,000. So now, how can you open a position worth $100,000, depositing only $5000? you are borrowing money from your broker. As the broker requires a 1% margin so for your buy position worth $100,000, your broker will take 1000 dollars as deposit money. And for any more particular position, your broker will do the same.

Suppose gbpusd is the only open trade in your trading account. So you have to maintain at least 1000 dollars equity at all times to keep your gbpusd trade open. Suppose your projection goes wrong and your gbpusd trade makes a loss, and your equity falls below $1000. In that case, your broker will automatically close your trade . by doing so, your broker is preventing you from making a further loss and making your balance zero. If you make a loss, then that loss will be deducted from your principal balance, and if you make a profit, then that profit will also be added to your principal balance.

Why don’t we use regular numbers rather than using lots?

The concept of the lot is totally new in the forex market. After emerging, the concept of using lots rather than using regular numbers becomes popular. It happens because of the development of computer technology and when forex trading becomes available through the internet.

As computers have taken the responsibility to calculate all the mathematical functions and manage trades, developers of the metadata trading platforms took large numbers. Instead of calculating 100,000 times, developers simply reduced it to 1 lot. As we know, one lot equals 100,000 units of currency. In short, for making calculation easy and speeding up the whole trading process, we use terms of the lot instead of large size units of regular numbers.

How to calculate spot forex profit and loss

As you already know how to calculate lot size in forex, you need to know how to calculate potential profit and potential loss with a real example of a eurusd currency pair. Suppose you decide to buy Eur and against the US dollar.

The present quote rate of EUR USD is 1.1854/1.1857. That means the bid rate is 1.1854, and the asking rate is 1.1857. As you are buying Euros, so you need to buy Euros at the asking price. Here the asking price is 1.1857 .you plan to buy one standard lot of eurusd that means 100,000 units of currency.

The very next day, the price moved from 1.1877. after seeing your massive profit, you decide to close your position. The new quote of EUR USD is 1.1877/1.1880. When you open the trade, you open it at the asking price but now, when you close the trade, you need to close it at the bid price. As the bid price is 1.1877 so, you need to close your buy trade at 1.1877.

Here the difference between 1.1877 and 1.1857 is 20 pips.

So the calculations will be like this = (0.0001/1.1857)x 100,000

=8.43×1.1857

= $10 per pip

For moving 20 pips = $10×20

$200

The final talk

Now you know what is a lot size in forex all about. Remember your selected lot size directly affects your account. When you place a high Lot trade where your account balance is low, then any small movements in the market could vanish your whole account like a blow of wind.

As the number of online brokerage houses increased, the competition also increased, and this increased competition among the brokerage houses resulted in various types of lot sizes. But if you want to become a professional trader, then from the very beginning, you need to be very selective about a lot.

Although there are nano lots, micro-lot, mini Lot, and standard Lot, you need to choose what best suits your overall trading style as the number of online brokerage houses increases. The competitions also have increased, .and this increased competition among the brokerage houses resulted in various types of lot sizes. But if you want to become a professional trader, then from the very beginning, you need to be very selective about a lot. Although there are nano lot, micro-lot, mini Lot, and the standard Lot, you need to choose what best suits your overall trading style.

Professional trader’s opinion about forex lot

“In the world of finance, lot size refers to a measure of a quantity”

James Chen

” The size of your forex trades will always be made up of lots”

Paul Langham

” In the context of forex trading, a lot refers to a batch of currency the trader controls “

John Russell

” Lots give you a way to look at the same quantity or increment of different currencies “

Tim Fries

” A “lot” is a measure to efficiently communicate standardized quantities of currency transactions “

Stefano Treviso

” Risk management is key when using lot size”

Mark Wilson

” You can calculate the overall size of your position by the size of a lot and the number of lots you’ve bought “

Daniel Smyth

Thank you!!1

i design it myself

thanks mate for the appreciation