The importance of the average daily range forex is that it will help us determine our position size. The average daily range tells us how much volatility we’re dealing with on a given day and if the market has been trending up or down.

If there’s an upward trend, then you would want to limit your position size by staying in only one trade per trading day. Whereas if you see this downward trend, then that means there are more opportunities for trades so take advantage of them!

Average daily range forex indicator

In the world of forex trading tools, there are a lot of technical analysis indicators that traders can use to predict what will happen next. One popular technical indicator is the Average Daily true Range Indicator. What does this mean? The ADR compares today’s high and low prices with yesterday’s high and low prices. And it tells you how much the currency pair moved on average per day during the past 14 days.

If the ADR is trending up, then it shows that the currency pair has been moving higher over time; if it’s trending down, then it means price movements have been decreasing for some reason. This information can help us understand where we think a currency might go in future trades!

How to calculate average daily range in forex

If you are a forex trader, then there are some indicators that you can’t live without. One of these is the ADR indicator. Now I will show how to calculate the ADR indicator in forex so that your trading experience will be more enjoyable and profitable! There is no average daily range calculator. Instead, you need to calculate it manually.

For say, we give our ADR indicator to take into consideration five days. The distances (true ranges) between the highest and the lowest point of each of these days are:

1.Day 1 = 50 pips

2.Day 2= 30 pips

3.Day 3 = 80 pips

4.Day 4 = 30 pips

5.Day5 = 40 pips

We will calculate ADR like this way

ADR = (Day 1 +Day 2 +Day 3 + Day 4 + Day5 ) / 5

And now our ADR will be

ADR = (50 + 30 + 80 +30 + 40) / 5

ADR = 230 / 5

ADR = 46

See, you don’t need any forex average daily range calculator. You can do it by yourself easily following the process stated above.

The fun fact is that you don’t need to do this manually, as the ADR indicator is there, which will do the mathematical function automatically for you. But as this indicator is not found in the mt4 or mt5 trading platforms by default, so you need to download it first then use it.

The only thing you need to do is just select the period value that you want the ADR to consider.

Forex average daily range table 2020

[table id=2 /]

How many pips does forex move in a day?

Pips are the smallest unit of movement in the forex. So it is common for day traders to ask how many pips does forex moves in a day? The answer is, on average, the movements on each pair are around 100 pips per day. But it can be much more or less depending on what’s going on with the markets.

Which forex pairs have the highest daily range?

The most volatile currency pairs are

[visualizer id=”393″]

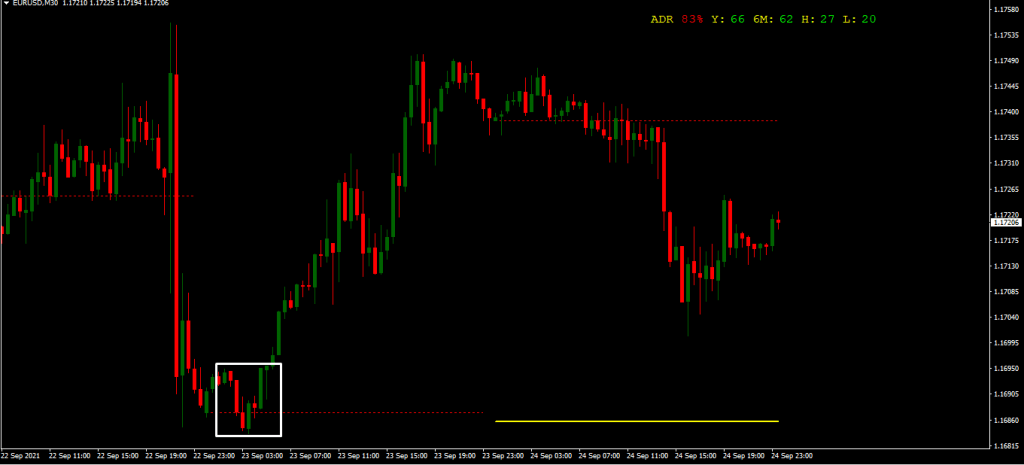

Trading Strategy Using the Forex Daily Range

How do you read an average daily range indicator? If you don’t read it correctly, you can’t produce a profit with this strategy. But if you read it correctly and know some market fundamentals, then this strategy could be a life-changer for you.

We will wait for the price to bounce back from the ADR level. If it bounces back from lower to upper and forms a bullish candle, we will open a buy trade.

Just take a look at the picture below.

Stop loss must be below the bullish signal candle. Therefore, we will take 1:2 risk-reward as a take profit target.

For a short trade, We will wait for the price to bounce back from the ADR level. If it bounces back from upper to lower and forms a bearish candle, we will open a sell trade. Stop loss must be above the bearish signal candle. Therefore, we will take 1:2 risk-reward as a take profit target.

Forex average daily range table 2021

[table id=3 /]

conclusion

With these tips, you can leverage the power of forex to your interest and gain a better understanding of how it works. Remember that there are four fundamental principles in trading; trend following, position-sizing, stop losses, and scaling out or hedging. These fundamentals will provide opportunities for trades as well as protect you from large drawdowns! It’s up to you to decide what strategy is best suited for your individual needs based on the information provided here today. But remember this one universal law – past performance does not guarantee future results.

However, today I showed what is the average daily range forex, how to find the average daily range forex, and how to use the average daily range in forex. If you read this piece of content thoroughly, then all of your confusion will be gone, and you will be able to use this small but potent tool in your day-to-day trading style.

Take a quiz

[qsm quiz=1]

Some more strategies like Average Daily Range Forex using custom indicators

- Secrets to accumulation/distribution indicator mt4

- How to trade forex using 1 2 3 pattern indicator

- Auto fibo trade zone indicator for 2022

- Non repaint reversal indicator mt4 free download

- Automatic support and resistance indicator mt4

- 3 level zz semafor indicator for 2022

- 3 ducks trading system for 2022

- 2 line macd indicator for mt4

- Best currency strength meter for 2022