Mechanical rules for trading are a set of trading rules by following what you take trades. What’s happening in the market or what’s other analysts or traders are talking about is not your headache. You just follow your pre-determined trading rules, no matter what happens

The benefit of mechanical rules for trading is they eradicate all your trading emotions. You just act like a robot. If you find entry or price hits your pre-set stop order or limit order, then your entry will be triggered. If the price reaches your stop loss or take profit, you will exit the market with a loss or profit. Here, you won’t participate in the market manually.

Benefits of Mechanical Rules for Trading

We all know that our emotions are our main blockage from profit-making. So when you trade without emotions or when your emotions don’t disturb you, the chances of making a profit increase.

Mechanical rules for trading also save your time. When you place limit orders or stop orders instead of market orders, then you won’t need to sit all day long in front of the computer to get the setup. Or you won’t need to check the markets 10 times in an hour, thinking whether your best opportunity is getting missed or not.

Practical example of Mechanical Rules for Trading

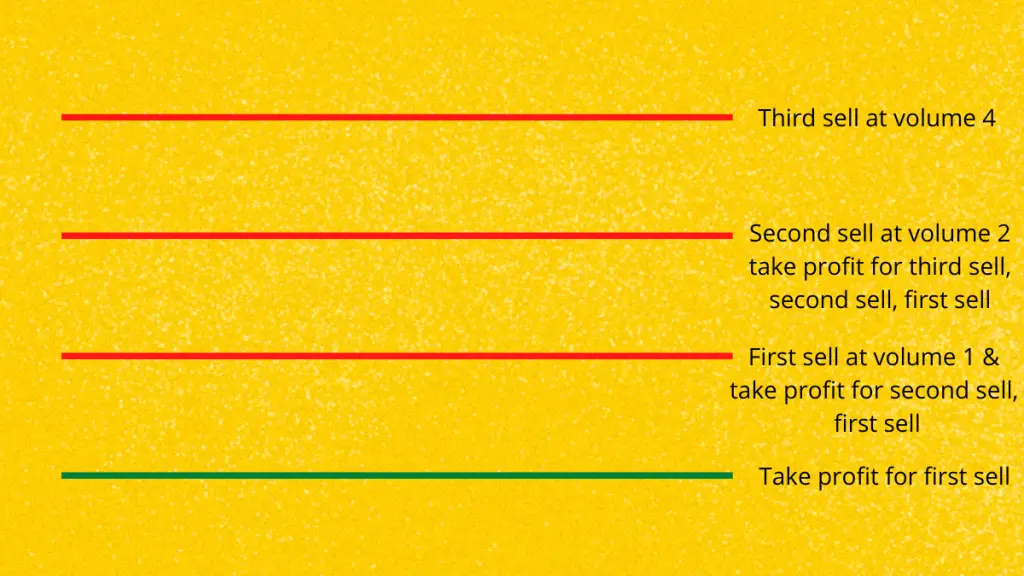

For taking trades using this strategy, you need a pivot point indicator. You just place 3 sell limit orders. The first one in first resistance with volume 1, the second one in second resistance with volume 2, and the third one in third resistance with volume 4.

For the first sell, set take profit at the pivot point, and stop-loss above the third resistance. Suppose you place a sell order in volume 1, and your trade hit first resistance and then started to fall and hit pivot point; then you make a profit. You become happy!

But what if your market hits first resistance and after that market does not turn. Instead, the market started to rise more. Then when the market hits resistance 2 then, your second order will be hit at volume 2. Then you set your second trade’s and first trade’s tp at resistance 1 point. As your first trade is open at volume 1 and your second trade will be open at volume 2, so on average, you will always make a profit.

If the price rises further before hitting your take profit, then this trade will be open at third resistance at volume 4. Now set your third trade, second trade, and first trades tp at resistance 2. This way, you will always remain in profit as your volume multiplies. It doesn’t matter whether you are making a loss first or second trade; at the end of the third trade, you will exit the market with a profit.

For buy set up follow the same rules just opposite direction. Here place buy trades on support instead of sell trades on resistance.

FAQs

1. What is the golden rule of trading?

The golden rule of trading is buying low and selling high. The forex market is like any other market. So what will you do to make a profit in any market? You buy the dip and sell it at a higher price. If you want to make money in forex, then you need to apply this same logic, which is the golden rule of trading.

2. How do you write a rule based trading plan?

I always open 3 trades. For sell, first sell at resistance 1 with volume 1, second trade on resistance 2 with volume 2, and third sell at resistance 3 with volume 4.