A huge number of trading systems are built on the signals of the Moving Average indicator. Somewhere one moving average is used, somewhere two, and in some strategies, three or more. We will consider triple moving average crossover strategy in this article. Here, as many as three moving averages will be used to search for signals. This strategy is suitable not only for Forex but also for short-term binary options trading.

Triple moving average crossover-a strategy for the foreign exchange market

Despite the fact that the developers initially intended to use this strategy only for Forex, today it is also used in binary options trading.To fix profit, you can use both a fixed take profit and a floating trailing stop.

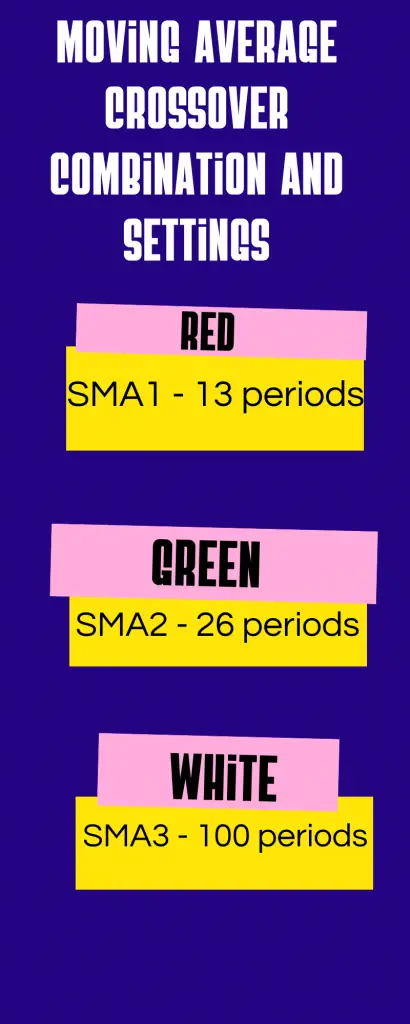

What is the best moving average crossover combination and settings

Three simple moving averages are used to search for trading signals. All lines have different periods and, after being placed on the chart, they resemble the Alligator indicator, which is also based on three moving averages.

If necessary, you can change simple moving averages to exponential ones. The latter are more sensitive to market changes and more likely to respond to chart fluctuations. The reason is that, according to the formula, exponential curves are more oriented towards the extremes of the chart.

Set three moving averages on the working pair chart (only SMA will be used in this example) with the following periods:

SMA1 – 13 periods, Red

SMA2 – 26 periods, Green

SMA3 – 100 periods, White

White moving average or SMA3 with a period of 100 determines the main trend. It is necessary to filter all signals by it. If the curve goes up and the candles are above it, then the trend is up and you need to consider only buy signals. If the SMA3 is moving down and the candles are below it, then the trend is down, we can only consider sell signals.

The intersection of SMA1 and SMA2 gives a signal to enter the market. The 13-period curve is the fast SMA and the 26-period curve is the slow SMA. The direction in which they intersect will indicate the type of new trade.

Trading signals produced by triple moving average crossover

To open a Buy trade, the following picture should appear on the chart

- The price is above the SMA3.

- The SMA1 and SMA2 lines should be above the SMA3 line.

- The red SMA1 line broke through the green SMA2 from bottom to top.

After the closing of the candle, on which the SMA1 and SMA2 lines crossed, a new buy order is opened. The trade can be closed by Take-Profit, trailing stop, or manually when the red and green lines cross in the opposite direction.

To open a Sell trade, the situation must be reversed:

- The price need to remain above the SMA3.

- Two other moving averages need to remain below the SMA3

- The red SMA1 line broke through the green SMA2 from top to bottom.

The combination of these signals indicates the development of a downtrend. A sell order should be opened after the signal candle closes, on which there was an intersection. If you open a trade earlier, the signal may be redrawn and the trade will be unprofitable.

It is recommended to fix the profit manually when the slow and fast moving averages cross in the opposite direction. If there is no time to follow the chart, then you can enable take profit or trailing-stop.

This strategy has one drawback. The moving averages are a little late behind the price, which is why the signals arrive a little later than the new trend has begun. When trading on M1 or M5 time frames, this can be a serious disadvantage.

Conclusion

Moving average is undoubtedly a powerful weapon in technical analysis. But to use it properly, you need to know how to use this tool perfectly. The triple moving average crossover strategy that I narrated above could be an excellent system for you if you analyse the market through this system. Then just practise this strategy in a demo account for a couple of months. When you feel confident, open a real account with a trusted broker and start making money like a professional trader.