We find many brokers online, but not all are suitable for trading view. As nowadays, the trading view gets super popular, so traders worldwide want to know which brokers are perfect if they wish to take the trading view service. So I will reveal the best broker for trading view, and as a trading view lover, if you read this content before depositing with any broker, you will be able to make the right decision.

Best Broker for Trading View

OANDA – TradingView

The best-recommended Broker in the TradingView platform is Oanda. Due to its history and reputation, Oanda has become one of the leading forex brokers, with a long list of awards and accolades. It has been active since 1995, and the brokerage uses the STP model.

How safe is Oanda?

Tradingview elected Oanda as the best and most popular Forex Broker for 2020; It is currently regulated in 6 countries; United States: NFA (0325821)CFTC, Europe: FCA (542574), Canada: IIROC, Asia: Singapore (CMS 100122-4), Japan: FSA of Japan and Australia: ASIC. The high regulation makes Oanda one of the safest brokers in the trading industry as its business practices have to align with the regulations of all of these regulatory boards.

Deposits, Withdrawals methods and leverage

There is no minimum deposit which means you can deposit as little as 1 dollar into your Oanda Trading account. You can use several methods to deposit and withdraw from your Oanda account. You can make bank transfers using the Debit and credit method; other methods include Neteller and Skrill. Deposits usually take a few minutes to reflect into your forex trading account after processing, and withdrawals may take 3-5 working days to reflect into your bank account. Depending on your jurisdiction and regulatory rules that govern leverage in your country, Oanda offers maximum leverage of up to 100:1, which means that for every $1 you deposit, you get a maximum of $100 that you can use for exposure in your trading.

Spreads

The spreads for currency pairs vary from one pip to about two pips, which are pretty fair compared to industry-standard spreads. It offers 45 currency pairs, including popular currency pairs such as GBP/USD, USD/JPY or AUD/USD, that can be traded 24 hours during weekdays. As spreads are low here, retail investors like OANDA broker very much for day trading.

Commissions

Because Oanda is an STP broker, it has to charge commissions to cover services costs, trade maintenance, and commissions vary depending on factors such as period of trade, size of the transaction, currency pair spreads, e.t.c. Because it uses a floating spread policy, commissions vary depending on current market volatility and other unforeseen factors. However, Tradingview provides a tool that you can use to calculate the cost of trade maintenance.

Advantages & Disadvantages of Best Broker for Trading View (OANDA)

| Advantages | Disadvantages |

| A large variety of currency pairs to trade | High commissions depend on different factors and circumstances |

| High security(regulated in many countries) | Varying spreads |

| $O minimum deposit | |

| Well established, reputable Broker |

FXCM – TradingView

Just like Oanda Forex Capital Markets, also known as FXCM, is one of the longest-running Forex brokers, FXCM was founded in 1999. It has offered services to both private and public financial institutions. It is listed on the New York Stock Exchange, which is an assertion to its reputation in the Forex Industry.

How safe is FXCM?

FXCM is regulated in three Tier-1 Jurisdictions; Europe: FCA (542574), Australia: ASIC and Canada: IIROC, making it a safe broker for trading Forex and CFDs and giving it a trust score of 93 according to FOREXBROKERS.COM, which is an independent rating agency that researches on broker safety and reputation.

Deposits, Withdrawals methods and leverage

FXCM allows traditional deposit and withdrawal methods such as Debit, Credit, Neteller and Skrill. The minimum deposit starts from $50. Deposits may take a few minutes to reflect into your trading account. Withdrawals may take 3-5 working days to be processed into your bank account. FXCM offers leverage may vary depending on your jurisdiction. Regulated jurisdictions have a maximum leverage of 30:1, which means for every $1 in your trading account, the Broker is willing to offer you $30 in exposure towards your trades.

Spreads

Typical spreads are one pip to two pips but may vary depending on your trade account type. There are two types of accounts; Standard account and Active trader account. Active trader accounts will have tight spreads, and Standard Accounts will have wider spreads, and this will be due to commission rules, as we will discuss in the following passages.

Commissions

Like Spreads, Commissions on FXCM are determined by the account type you will be trading between; Standard account and Active trader accounts. If you are a day trader, you will love to trade under the standard account of FXCM as Standard accounts do not have any commissions; however, the Broker uses spreads to make up for the lack of commissions as this account will have wider spreads on the offered currency pairs. The Active trader accounts will have commissions, and commissions will be determined by the size of trades and the period that the transaction will be open; the benefit that comes with this account is tighter spreads and commission discounts when open trades are closed.

Advantages & Disadvantages of Best Broker for Trading View (FXCM)

| Advantages | Disadvantages |

| Monthly detailed execution reports highlighting slippage and trade quality | Slightly higher spreads and commissions compared to typical rates |

| Highly regulated(safe Broker) | Higher minimum deposit compared to competitors |

| Leading Broker in algorithmic trading technologies | |

| Good 24/5 customer support |

If you are a U.S. citizen, you won’t trade with an FXCM broker. As FXCM doesn’t accept U.S. clients. Td Ameritrade would be the best option for you as a U.S. citizen. Although many brokers exist, TD Ameritrade is the most popular broker and best online broker for U.S. active traders.

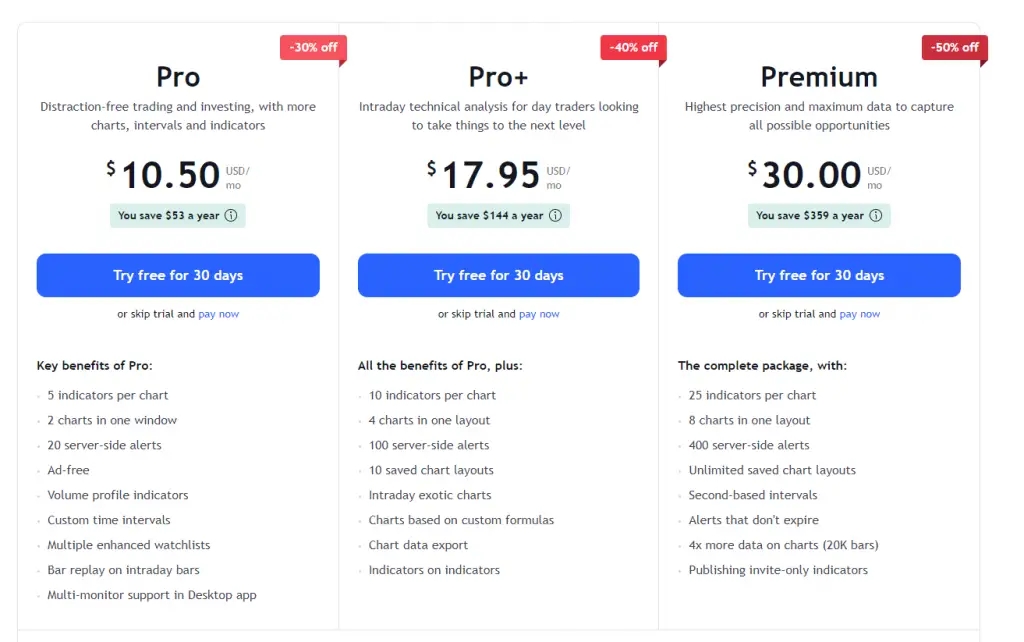

TradingView review, History & Background

Tradingview is one of the best independent financial charting platforms in the trading industry. For doing technical analysis, professional traders like to use tradingview. However, you can do many things with tradingview basic plan for which you don’t need to cost a penny. But suppose you want to go one step further and enjoy more premium features like Custom indicator templates & tradingview charts of Custom Range bars. In that case, you should take tradingview pro &tradingview premium account.

It was founded in 2011, and it has offices in London, New York and Russia. It has had an unprecedented rise in popularity in the last few years due to the recent increase in interest in trading and investing. It was founded by Stan Bokov, Constantine Ivanov and Dennis Globa. It currently supports 19 languages and has over 8 million users worldwide.

Tradingview acts as an intermediary between brokers and traders striving to give the industry the best charting and social services. It provides the best technical indicators, custom indicators and other advanced tools to enhance trading quality and charting experience. When you become a professional trader, you can also share your trading idea & trading strategy, which could benefit many newcomers.

Benefits of a tradingView user

If you use a trading view chart, you will get trade ideas on various foreign exchange markets. Forex chart, futures, stock charts, TradeStation crypto, mutual funds all market data is available here. And the chart layout is lovely.

TradingView supported brokers

I am giving you a tradingview broker list

| FXCM | TradeStation |

| OANDA | iBroker |

| Pepperstone | Forex.com |

| Paper Trading | Saxo |

| currency.com | Tickmill |

| Capital.com | WH Selfinvest |

| Bingx | IRONBEAM |

| Global Prime | Optimus Futures |

| Tradovate | Tiger Brokers |

| AMP | Timex |

| Alpaca | Gemini |

| easyMarkets | Alor Broker |

| Chaka | Ally Invest |

| CQG | Bitstamp |

How to connect broker to TradingView

Step 1- Open tradingview pro account

Step 2- Open chart window

Step 3- At the very bottom, you will find “Trading Panel”. Click there.

Step 4- You will find a list of supported brokers.

Step 5- Choose your funded broker and select that

Step 6- Then trading view will take you to your brokers’ page

Step 7- Then input your brokers’ username and password

That’s it. Now you successfully connect your broker with TradingView charting platform.

Conclusion

Having a great broker can play an essential role in your trading career. Knowing the key components that separate good brokers from average brokers is always vital, so it is crucial to keep the discussed factors in mind when choosing a broker. I have given a list of 28 brokers, but for forex trading the best broker for trading view will be OANDA or FXCM

FAQs

Q. Can I trade through TradingView

A. Yes. TradingView has partnered up with brokers to provide a charting platform that connects to brokerages and can be used just like MT4/MT5 to analyse and execute trades.

Q. Is TradingView a good broker?

A. TradingView is not a broker. It is a financial charting tool that is used to view charts plans and apply trading strategies. It also has a function to connect to certain brokers so that you can ultimately use it to execute trades.

Q. What Broker works best with TradingView

A. multiple brokers that work best with TradingView, Oanda and FXCM are highly recommended for numerous reasons.

Q.How do I choose a broker on TradingView?

First, Open tradingview pro account. Then Open chart window. Finally At the very bottom, you will find “Trading Panel”. Click there and choose a broker from the list.