There are many default forex trading indicators like moving average, Bollinger bands, stochastics, Relative strength index, MACD, commodity channel index,momentum indicator,Average true range (ATR) etc. All of them are useful and can produce a profit if you can handle them properly. Some customised indicators like 3 level ZZ semafor, non repaint reversal indicator, elliott wave indicator are also fantastic if used professionally.

But when it comes to the best indicator for forex trading, I will undoubtedly refer to the Ichimoku Kinko Hyo forex indicator. The irony is that most of the traders misuse Ichimoku Kinko Hyo. Today in this piece of content, I will discuss the 5 secrets about this best indicator for forex trading, how to use Ichimoku correctly and how you can take buy orders and sell orders.

Know the basics of Ichimoku Kinko Hyo- best forex Indicator

The Ichimoku is one of the oldest technical indicators and has consolidated its reputation in the trading industry. It roughly translates into ” What a man sees from the mountain’s peak.

The creator Goichi Hosoda released Ichimoku Kinko Hyo in 1969. His hopes were for an indicator to predict future trend changes and visually represent them as accurately as possible within price movement. The technical indicator has proven to be a success, as it is still highly recommended, especially for Japanese yen based currency pairs.

It comprises Two leading spans(Senkou span A and Senkou span b), a lagging span(Chikou span), Ichimoku clouds, a Baseline(kijun sen) and the Conversion line(tenkan sen).

The baseline and the conversion line are classified as signal lines, and the markets tend to change trend direction when the Baseline and conversion line crossover. The Ichimoku cloud acts as a support and resistance line that follows price. The lagging span serves as a line representation of price and therefore factors out erratic price behaviour. The lagging spans serve as a confirmation of the trend, and they form the Ichimoku cloud.

5 Secrets About this Best Indicator For Forex Trading

- You can use Ichimoku Kinko Hyo to determine the market direction.

- Ichimoku Kinko Hyo acts as a strong support and resistance level.

- If you are a swing forex trader, Ichimoku could be your best choice as it detects trend signals from many false signals from the forex market. That’s why many call it as trend trading indicator.

- Ichimoku Kinko Hyo determines the direction of the reflection of human behaviour.

- Ichimoku Kinko Hyo determines the breakout signals perfectly.

| Name | Traders name it as | Color | Represent |

| Tenkan Sen | conversion line | Red | (Past 9 period’s highest high+ past 9 period’s lowest low )/2 |

| Kijun Sen | baseline | Blue | (Past 26 period’s highest high+ past 26 period’s lowest low )/2 |

| Senkou Span A | first Senkou | Sandy brown | (Tenkan Sen + Kijun Sen)/2 |

| Senkou Span B | second Senkou | Thistle | (52-period high + 52-period low)/2 |

| Chikou Span | lagging line | Green | Current closing price which is plotted based on 26 period’s back data |

Trading strategy based on best indicator for forex trading

How to enter a Buy signal

Firstly, wait for the price to break and close above the Ichimoku cloud. As we know, the Ichimoku cloud acts as a support and resistance line, so when the price strongly breaks and closes above the cloud, we can predict that the public sentiment is shifting from selling to buying.

Secondly, we will check whether there is any crossover between the conversion and baselines. If the conversion line breaks the baseline above, we will enter the buy trade.

Here we can observe that the conversion line (red) crosses above the baseline (blue), and we find a strong bullish candle that breaks and closes above the cloud. We will enter the trade here. Our stop loss will be below the signal candle’s or entry candle’s low. When the conversion line crosses the baseline from above to down again, we will exit the trades. Like this example, if you take this trade, you would make 208 pips in a single trade.

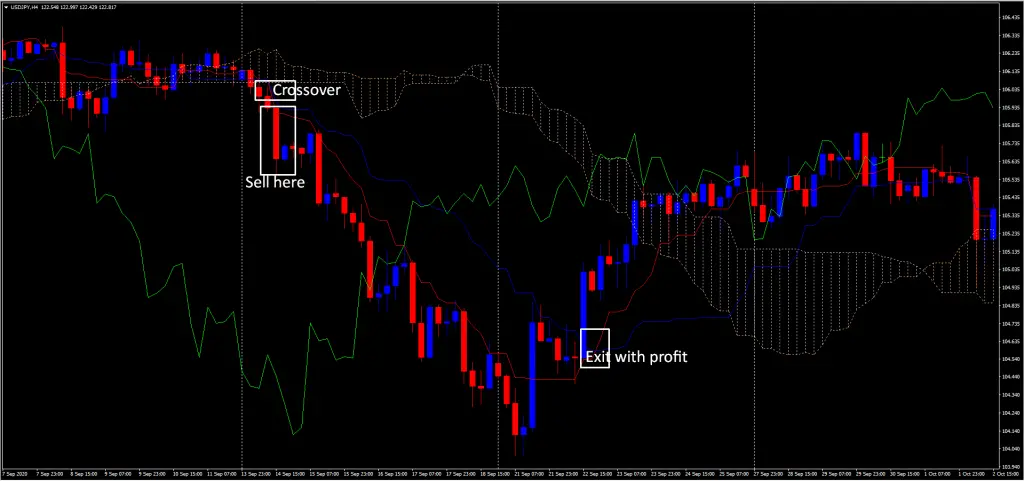

How to enter a sell signal

Firstly, wait for the price to break and close below the Ichimoku cloud. As we know Ichimoku cloud acts as a support and resistance line, so when the price strongly breaks and closes below the cloud, we can predict that the public sentiment is shifting from buying to selling. Secondly, we will check whether there is any crossover between the conversion and base lines. If the conversion line breaks the baseline below, we will enter the sell trade.

Here, we can observe that the conversion line (red) crosses below the baseline (blue), and we find a robust bearish candle that breaks and closes below the cloud. We will enter the trade here. Our stop loss will be above the signal candle or entry candle’s high. When the conversion line crosses the baseline from below to above again, we will exit the trades. Like this example, if you take this trade, you would make 95 pips in a single trade.

Pros & Cons of best technical indicator for forex trading

Pros

- Available in the mt4 platform.

- Available in the mt5 platform.

- Available in web trading platform.

- You can trade with this indicator in any forex broker.

- Scalping, day trading, and swing trading are possible through Ichimoku Kinko Hyo.

- Best suits for jpy pairs.

- Trading signals produced by Ichimoku are accurate at more than 90%.

Cons

- Choppy currency pair doesn’t produce profit through this indicator.

- If you use the Ichimoku Kinko Hyo strategy, you can’t combine any other indicator like Bollinger bands indicator, volume indicator, and pivot point to take trading decisions.

Best trend reversal indicator mt4

There are many mt4 indicators. Some are default, and some are customised. Most of these indicators are reversal indicators. But All of them are not equally effective. If you are a trend reversal trader, Ichimoku Kinko Hyo & Bollinger bands squeeze indicator mt4 could be your best weapon.

The best indicator for forex day trading

If you are a day trader and use lower timeframe like 15 minutes then MACD would be best If you are a day trader and use a lower timeframe, like 15 minutes, then MACD would be the best choice. 1-minute MACD strategy makes handsome profit daily basis. Traders who find Ichimoku difficult can try any simple strategy based on MACD.

Conclusion

Technical analysis is a forever evolving style of analysing the market. As a forex trader, you have to be open to constant learning because financial markets are constantly changing. Having a basic knowledge of indicator use cases will give you an edge. If you struggle to have a clear view of market direction using one indicator, you can always switch and use another indicator.

But if you want to become a consistent profitable trader then you should always stick to this best indicator for forex trading-Ichimoku Kinko Hyo

FAQs

Q. Which indicator is the best for trend reversal analysis?

A. Ichimoku Kinko Hyo is one of the best trend reversal indicators.

Q.Which indicator is the best for Momentum trading?

A. The Bollinger bands indicator is one of the best momentum indicators