0.1 lot size in dollars

Forex markets are not only for investing but also for retail purposes, like exchanging currency during travelling, exports and imports foreign direct investing.

It is an accessible market for regular people to participate in; unlike other Financial markets, there is a low capital entry which means it does not require much money to trade Forex. Thanks to technological advancement, currency can be traded anywhere, anytime and by anyone.

What is a lot?

A Lot is a measurement unit used to calculate a transaction volume in Financial Markets; it is a number unit of a financial asset bought by an investor or forex trader. Forex traders use lots to buy or sell one currency against the other.

There are four types of lot size categories in Forex trading, Micro, Mini and Standard; the categories are unique in the size of exposure and profit/loss expediencies

Different lot size

Nano Lots

A Nano lot is the smallest unit available to retail traders. Most brokers offer Nano accounts, also labelled as a cent account; this allows you to trade smaller currency increments. The Nano lot is the best account for beginner traders who want to get the experience of trading forex in a real account without exposing too much of their starting capital. The recommended account size for this trading volume is anything above $1 to $90.

The best lot size for $10

The best lot size for a $10 dollar account is a nano lot. As you begin trading, you will find it hard to find your consistency, and that is why I recommend the Nano lot as the best for a $10 account. Still, as you gain experience, you will be able to use the micro lot size, and you will find that consistency is what brings success in Forex trading, your ability to make pips and keep them is the key to profitable trading.

Micro Lots

Micro lots are the minor lot size units. They are in the second decimal place of the lot size, from 0.01 to 0.09. micro lots are recommended for trading accounts ranging from $100 to $900 because the premise of suitable trading is not exposing more than 1% of your trading account on a single trade. This is what makes micro-lots perfect for this account balance range.

An execution of 0.01 equates to one U.S dollar, so you would need at least $1 to run a 0.01 lot trade execution. However, considering factors such as Leverage, management fees, and spread, you might not be able to open a 0.01 lot trade with an account balance of $1.

Example of micro lots ( 0.01 lot size profit )

0.01 lot size per pip will be 0.10 dollar or 10 cents more or less. Suppose you open a buy trade on AUDUSD, where AUD is the base currency and USD is the counter currency. The next day your trade makes 80 pips profit. Then you will make more or less 8 dollars profits.

0.05 lot size example

I am giving here another example to clarify micro-lots more clearly. Suppose you open a sell order in USD/CAD at 1.2600. price drops, and it hit your stop loss at 1.2700. That means you will make a loss of 100 pips. If you used 0.05 lot size, your loss would be 50 dollars.

0.01 lot size calculator

Till now, I was showing you how to calculate lot size manually. If you don’t understand the basics, you will suffer a lot in the long run. But the fun fact is you won’t need to do it manually all the time. As there are many calculators to calculate lot size online. Like you can use babypips lot size calculator or myfxbook lot size calculator to count the lot easily

Mini Lots

Mini lots range from 0.10 to 0.99. Executing trade of this lot size is recommended for accounts with a capital range of at least $1000 to $9000. Mini lots are perfect for someone who has experience of more than a year of trading the forex markets.

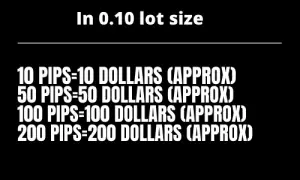

0.10 lot to $ value/0.1 lot size per pip

A 0.10 lot size will need a margin of $10, so ultimately 0.10 equates to 10 U.S dollars, so if you were to calculate pip movement for a mini lot trade of this size, one pip would be equal to one dollar, so if you were to enter a setup. It moves ten price interest points(pips) to your direction, you would profit, but if the trade goes 10 pips against your trade, you will lose $10.

Example of 0.1 lot size in dollars

0.1 lot size per pip will be 1 dollar more or less. Suppose you open a buy trade on EURUSD where EUR is the base currency, and USD is the counter currency. The next day your trade makes 50 pips profit. Then you will make more or less 50 dollars profits.

One more example on 0.50 lot size in dollars

If you use a larger lot size like 0.50 lot, then 0.50 lot size per pip will be 5 dollars more or less. Suppose you open a sell trade on GBPUSD, where GBP is the base currency, and USD is the counter currency. The next day your trade makes 100 pips loss. Then you will make more or less 500 dollars loss.

Which trading strategy is perfect for 0.1 Lot size

- 20 pips and dip stratgey

- 1 min macd scalping strategy for 2022

- 20 pips a day forex strategy for 2022

Recommended trading capital and forex pair for 0.1 lot size

If you use 0.1 lot, you shouldn’t use less than 1000 dollar capital in your account. You have chosen to trade under mini account on 0.1 lot, so it is guessable that you won’t open too many trades. Again, if you trade local or exotic currency pairs, your Profit will vanish by the names of spreads. That’s why try to stick to only major pairs. Better if you chose a few from the whole list of 28 pairs. However, I am giving a list of which forex pair you should trade on 0.1 lot size on $1000 capital.

- EURUSD,

- GBPUSD,

- USDJPY,

- EURJPY,

- USDCAD,

- USDCHF,

- AUDUSD,

- NZDUSD,

- GBPJPY,

- AUDJPY,

- NZDJPY.

Recommended Leverage for 0.1 lot size

Most good brokers do not go above Leverage of 1:500; 1:500 Leverage is suitable for traders with intermediate expertise. For beginners, I would recommend anything leverage below 1:500 as it won’t allow you to make the mistake of risking too much of your equity.

Standard Lots

A standard lot is the most significant unit used to measure trading volume, the day you reach a point where you can open a standard lot trade is a day you will surely know that you are close to achieving financial freedom.

When you open a standard lot size trade, you temporarily exchange 100 000 units of the base pair. A 1.00 lot size will need a margin of $100, 1.00 lot is equal to $100, and for every pip made on a trade with a 1.00 lot volume, you can expect to make $10, and for every pip lost, you can expect to lose $10 of your equity.

The correlation of LOTS for profits and losses/forex lot size chart

| LOT SIZE | UNITS | VOLUME | $ / PIP |

| Standard Lot | 100 000 | 1.00 | $ 10/ a pip |

| Mini Lot | 10 000 | 0.10 | $ 1.00/ pip |

| Micro Lot | 1 000 | 0.01 | $ 0.10/pip |

| Nano Lot | 100 | 0.001 | $ 0.01/pip |

How Profit and loss is made in Forex

If you are using a dollar account and buying EUR/USD, you are exchanging 100 000 dollar units for 100 000 Euro units, and you are technically investing in the strength of the Euro. If the Euro strengthens, you will make a profit, but if the Euro weakens against the dollar, you will make a loss.

So the strength and weakness of a currency pair essentially create a market, and the movements are what you will aim to profit from.

How to Avoid Margin Calls

Margin calls are technically a notification sent by a forex broker when a trader’s account falls below the required amount needed to keep trade running.

It happens when you take massive losses when you use LeverageLeverage. You are using money lent to you by the broker. For the broker to protect itself, it uses the margin call policy to close trades that may put the broker at risk of losing the money it lends to you to run transactions.

To avoid margin calls, you can use low Leverage. Even though it will cost you the potential of making good profits, lower Leverage can also save you from losing your account on a few trades, Don’t over-leverage your trades.

Overleveraging is the action of opening a trade that is more than 10% of your trading account. 10% doesn’t sound like much, but if the forex market moves 50-60 pips against you, you will surely lose most if not all of your equity.

Conclusion

Using the recommended forex lot size will benefit you most as you learn. It will keep you in the trading game for a long.

As you know, persistence and hard work build character, and if you trade long enough, you will learn the little nuances that you need to become a good trader, so make sure that you follow the advice given by your mentor. Use Leverage wisely and trade on.

FAQs

Q. How many dollars is 0.01 lot?

A. 0.01 is equal to more or less ten cents or 0.1 dollars in value.

Q. How much is a 0.10 lot size?

A. 0.10 lot size is equal to more or less $1 in dollar value.