Lot sizing is a crucial fact in forex trading. When you start your forex trading training, the first thing you have to go through is lot sizing. If you don’t fix your lot size accurately, you could vanish your account even with a little movement of the forex market. As most retail traders start trading forex with thousand dollar accounts, today I will discuss the best lot size for $1000.

The best lot size for $1000

If your trading capital is 1000 dollars, then you should use 0.05 lot size or less than 0.05. The amount of your trading capital basically defines the lot size.Let’s assume that your trading account balance is in USD, and you plan to buy a GBP/USD currency pair. As here, your trading capital is $1000, so you should risk 4% in every single forex trade.

In micro lot size =1 pip in 0.01 volume = $0.10

1 pip in 0.05 volume = $0.50

So if you risk 4% then (1000×4%)= $40

This means you can open an order worth 40 dollars in each forex trade. More specifically, to lose 40 dollars, you need to lose 80 pips in every forex trade. If you lose 80 pips, then your stop loss will be hit. 40 dollars or 80 pips is not a big deal in day trading. If you lost $40, then you still have $1000-$40=$960 remaining.

You can still open another trade or trades easily. So you don’t need to get tense! But if you opened a big volume like 0.40, then if you lost in a single trade, you lost 80 pips or $320. After making such a huge loss, you get devastated. In most cases, traders tend to start over trade or revenge trade. Which results in more loss, and ,traders blow their account at one point. That’s why I always suggest using no more than 0.05 volume in a $1000 dollar account.

Trading strategy using best lot size for $1000

| Timeframe | 1 hour |

| Indicator | 20 simple moving average |

| Trading opportunities | 1-2 trades per day in every currency pair |

| Works best | trending forex market |

| Trading pair | major, minor, exotic |

Trading rules to go long:

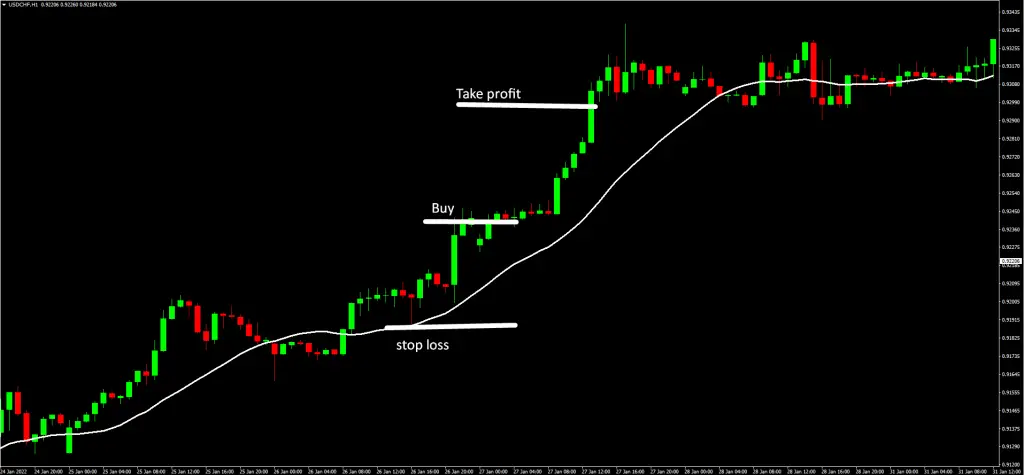

When the price breaks 20 simple moving averages, observe the forex market very closely. If the price comes back to 20 moving average again and rejects it or closes above the 20 SMA with a strong bullish candle, then a 0.05 volume buy trade is opened.

Stop-loss or risk management system:

just place your stop loss below the recent low. We are placing 0.05 volume trade risking 4 % of our balance, so don’t take more risk than 80 pips.

Take profit:

your take profit must be 1:1. That means if you risk 65 pips, then your profit would be 65 pips. If your stop-loss is 80 pips, your T/P point would also be 80.

Trading rules to go short:

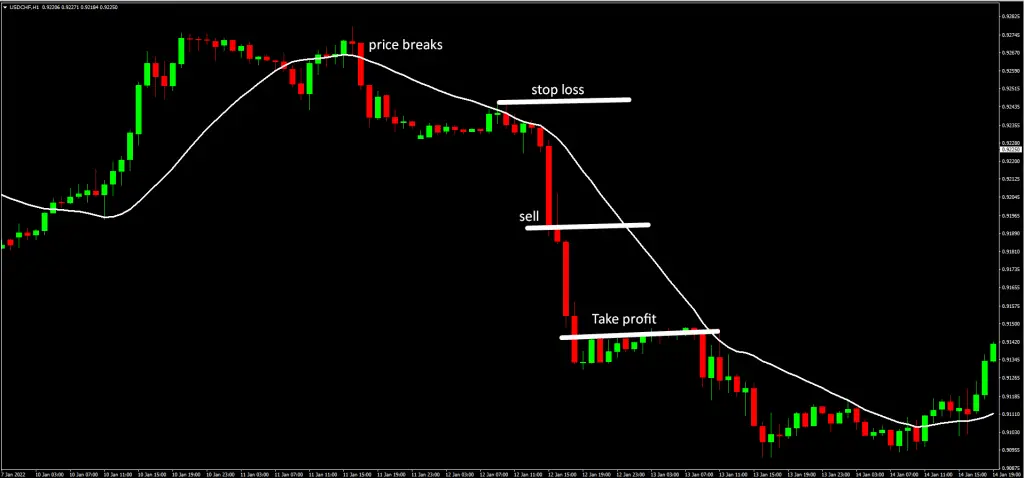

When the price breaks 20 simple moving averages, then observe the forex market very closely. If the price goes back to 20 moving average again and rejects it or closes below the 20 SMA with a strong bearish candle, then open a 0.05 volume sell trade there.

Stop-loss or risk management system:

just place your stop loss below the recent low. We are placing 0.05 volume trade risking 4 % of our balance, so don’t take more risk than 80 pips.

Take profit:

your take profit must be 1:1.

Just check how beautifully our buy and sell both trades hit take profit.

Forex lot size and leverage

There is a close connection between position size and leverage. Position size and leverage go hand to hand. If you want to wet your feet in forex trading, you must have clear lot sizing and leverage concepts. Leverage is the funds that any trader borrows from his forex broker. Margin trading or leverage trading is a very popular term in financial markets like foreign exchange markets, CFDs, stock markets, and crypto markets. The bigger the leverage you use, the more you can afford to trade long or short.

And the lot is the contract that is measured in base currency units. Here, we discuss the best lot size for 1000, so we find 0.05 lot size would be the ideal position size under 1:400 leverage.

Four kinds of different lot size

| Standard lot (100,000) | 1 | $10/pip |

| Mini lot (10,000) | 0.1 | $1/pip |

| Micro lot (1,000) | 0.01 | $0.1/pip |

| Nano lot ( 100) | 0.001 | $0.01/pip |

Now you can easily calculate your dollars based on lot sizing. like 0.01 lot size in dollars would be $0.01 or ten cents 0.1 lot size in dollars would be $1 or one dollars. Isn’t it easy to calculate?

Forex lot size calculator mt4

Many novice traders search for a forex lot size calculator mt4 to install it to their mt4 terminal. But there is no need to download it and install it on your terminal. Instead, you can easily get it from any online calculator platform like myfxbook. From here, you can easily calculate your lot size or position size. If you can do this simple task easily online, then why do you wish to get extra pain to get this tool in your mt4 or mt5 terminal? Is there any sense in doing it?

Forex lot size calculator excel

Instead of finding a forex lot size calculator mt4 which is already there in an online calculator, you can search for a forex lot size calculator excel. This excel sheet is very effective when you calculate your risks. Here I am giving an excel sheet based on which position size would be the best lot size for $1000. Just input your risking percentage or pips you wish to risk and the detailed data you will get. After starting with a thousand dollars, if you make a profit and wish to increase your balance, just modify your digits in the yellow box I gave! Just download the sheet, and you will be amazed to see its effectiveness. Thanks me later!

what is the largest lot size in forex trading

Although it’s a bizarre question as we traders don’t trade such big volumes, as forex traders, you should know the answer, which is the largest lot size. Top-rated broker and will permit you to open trades up to 100 lots. You won’t open a bigger trade size than 100 lots under standard lot volume.

The Bottom line

Any retail forex trader finds it difficult to manage 1000 dollars to invest his account. So more than this amount sometimes seems impossible to them. And if any forex trader wishes to trade with this amount, he must need to take help of leverage. But when a trader uses leverage, he needs to be very cautious. Because wrong leverage with wrong lot size is nothing but lethal in forex trading. This piece of content will help you understand all about the best lot size for $1000 and every detail associated with it!