Buy low sell high forex strategy

The basic principle in forex trading is getting the best price. Most often, Successful traders will tell you that they used this principle to get rich even in a retail business, the aim is to stock up products at a low price whilst there is still supply and later sell the product with higher pricing when there is demand.

Markets are built on this rule and are respected throughout every market you can find, so we will be using this same rule to construct an optimal strategy for finding areas to buy and sell forex currencies.

The strategy is based mainly on a candlestick pattern. If you wish, you can use the Supply and Demand rule as a confluence to confirm future trends and enter trades upon confirmation.

Pin bars in trends

Pin bars are a typical candlestick pattern, you will find them in supply and demand areas more often, and during trends, they are what we call fake outs. When they happen during a price trend, it will seem like a trend is reversing, then all of a sudden the reversal fails and a pin bar is formed, then trend continues as expected. We aim to trade the movement because that is how you will make a good amount of pips.

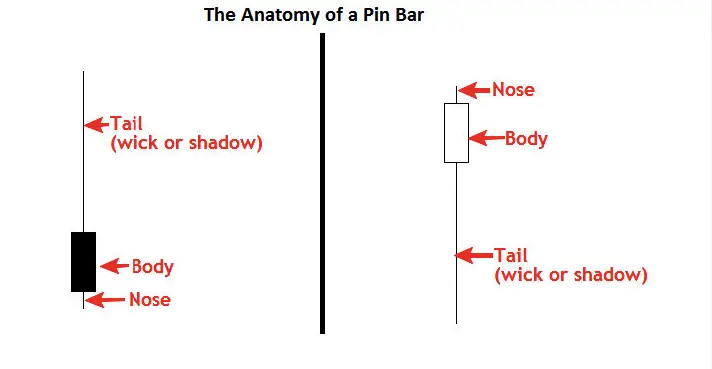

Pin bars are essential Japanese candlesticks that have a large wick or pin and a short body, The pin will form towards the opposite direction of a trend. A bearish pin bar will form after an uptrend, then create a high, and the market will begin a downtrend. The opposite will happen when analysing an uptrend trade. Markets will be completing a downtrend, and a bullish pin bar will form to make a peak low, then the price will begin an uptrend, easy, right?

As easy as it is, it will take time for you to get used to seeing this setup as they happen. If you are a trend trading lover, this trading strategy is not for you. Because this forex trading strategy is based on catching counter-trend. When any trend finishes, we will enter the market to catch the next move from the very beginning.

One common mistake you will make is taking reversal pin bar setups whilst markets are still in a trend. These are known as fakeouts, but you will learn how to filter out the suitable structures from the bad ones with practice and chart time.

The above image illustrates bearish and bullish pin bars.

Like other candlesticks, the pin bar has variations and may not necessarily appear as represented in the image. You may need to learn the Doji pin bar for one other type of pin bar. The Doji pin bar may open at one price point, form a peak high or low, then close near or at the same price as the candle’s opening price.

The above image represents a bearish and bullish Doji pin bar.

Psychological price points

When we talk about psych price points, we are looking at price levels that would appease institutions and professional traders to buy or sell a currency. Humans are more inclined towards numbers that have zeros primarily. We are looking at price points like; 1.1000, 1,2000,1.3000. Why should these numbers be a focus? You might ask, well, the answer is easy. Supply and demand influence price. Most often, it’s a primal human instinct to think that something is priced reasonably or not when it reaches a certain psychological price point.

Analysing markets and implementing the Buy low sell high forex strategy

The critical component in every strategy is finding the long term trend, as this will help you establish areas to look for pin bars that you can use to enter trades.

Bearish trade setup

When you are sure of the general trend direction, then you will start looking for entry candles, In a bearish trend, you will look for bearish pin bars.

Bearish pin bars setup

The image above illustrates bearish pin bars in a downtrend; it is always best to enter bars that show a bearish rejection to the high, avoid entering pin bars that form after the price has moved away from the Lower highs.

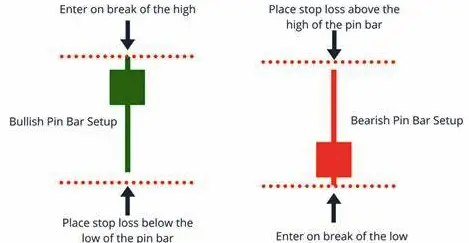

Bearish Pin bar Entry and stop-loss

Entries are vital in trading. A good entry will maximise your profits, so knowing when to enter a trade is essential. In this case of a bearish pin bar, the optimal access is after the candle closes, and you are sure that it has the characteristics of a bearish pin bar.

The image above illustrates how to approach bearish pin bar entries, including the stop loss level. The pin bar’s size will determine the size of your stop-loss. Also, consider adding the spread of the currency pair as a precaution.

Your risk-reward ratio will determine your take profit. Remember to be realistic when setting your profit targets because markets do not move in one direction.

Bullish setup

What will entail a bullish setup is a long-term uptrend; you have to see the trend forming, price coming from a low and making high highs and higher lows.

When you are sure that the price is in an uptrend, you aim to find bullish pin bars near or on the Higher lows, pin bars can vary, so it is advised to know the different types of pin bars.

Bullish pin bars in an uptrend

The image above illustrates Bullish pin bars in an uptrend.

Bullish Pin bar entry

The Bullish pin bar entry approach will be the same as the Bearish pin bar entry. The difference is that you will be executing a buy trade this time around.

Awareness when trading pin bar

1/As a trader you need to be choosy when pick trade based on pin bar pattern. In forex market various types of pin bar is created. But not all of them should be traded. you will notice many pin bars having low wick. Just avoid these pin bars. Remember pin bar’s wick need to be as long as thrice the body. If you choose wrong pin bars then you will end yourself losing more money that earning through trading.

2/Don’t trade all the currency pair. forex pair plays a crucial role in pin bar trading. Investors are Retail traders need to stick only top traded 28 major forex pairs. If forex traders start to trade local currency pair or exotic currency pair using pin bar strategy then out of ten trades he will make loss in 7 or 8.

3/ This buy low sell high forex trading strategy works best in London and New York sessions. If you trade on Asian sessions then you won’t make profit. However if you live Asia and you find it problematic to trade on US session then stick to swing trading. For swing trading using pin bar you need to use higher time frames like 4 hour or daily or weekly charts.

4/ When there is liquidity you will find more trades then. That’s why you will always find more trades or trading opportunity on japanese yen pair like GBP/JPY,EUR/JPY and so on. So when you trade on Japanese yen pairs then remain active. If you don’t take your profit then sometimes your trade can back from profit to loss point.

5/Foreign Exchange market is always uncertain and trading with pin bar is more uncertain. So you should always use stop loss in your every trades.

6/Some forex brokers increase spreads at the midnight when next day’s candles opens. So when open account check your forex broker’s reputation or are there any bad reviews regarding spreads.Trade forex with high regulatred brokers like IC markets,Nadex,TD ameritrades and so on.

Best trading platform when you apply buy low sell high forex strategy

You can use any platforms like mt4, mt5, cTrader, or web trading platform. There is no such rules that you should use only mt4 or only cTrader. But if you use such platforms which have more customised time frames like 10 minutes or 2 hours then you will get more trading setups. cTrader has this feature.If you want to be a professional forex trader then doing technical analysis on multi time frame is a must for you.

Conclusion

I do not doubt the effectiveness of this strategy. This strategy is not only effective on foreign exchange trading but also on binary options and stock market. You have to be willing to put in some chart time so that you can be able to develop an objective approach to it and trade it as a trading system. Pin bar set up is very popular in day trading. However many swing traders also use higher time frames like 4 hour or daily charts pin bar to catch market’s major swings.

Learn more. Do some back-testing and test it on the time frame you will be using to trade. Considering that time frames will affect profit potential, higher time frames will offer more pips, and lower time frame setups will offer fewer pips, it is best to trade in line with your trading style.

FAQs

Q. What does Buy low Sell high mean?

A. It means buying at the possible lowest price and selling at the possible highest price points of a currency.

Q. Why do we Buy low and Sell high in forex?

A. We Buy low and sell high to make optimal trade entries and maximise our profit potential.

Q. Does Buy low Sell high work?

A. Considering that most strategies are created from the concept of buying when the price is at its lowest and selling when the price is at its highest, you can say that it does work. Moreover, if you want to make a consistent profit in forex, then there is only one way: buy on higher low and sell on lower high.