“How to get rich from forex trading strategies” is a common question asked by new traders and even by professional traders. As ninety percent who trade Forex lose money today or tomorrow, no matter how sophisticated a trader you are, you also have to pass a losing streak of trades.

Almost all traders get confused by “Is it possible to make millions in forex?” “How much do forex traders make a day?” “how to become a millionaire trading foreign currencies.”So in this piece of content, I will cover some secrets about how profitable forex trading is and how Can you get rich, trading forex. Keep reading.

Why traders lose money in Forex pair

- Lack of proper training

- Trade randomly without a rock-solid planning

- Indiscipline

- not possess a solid profitable trading plan

- Poor money management

Although every trader passes a lousy time, if you are a consistent loser, then check out these 5 golden losing factors whether you possess one of these or not.

Who loses money in Forex? And is forex trading profitable?

If you are an unemployed person or earn a tiny amount that is insufficient to support yourself, then the chance is higher that you will lose all your money. Sometimes many come to Forex to repay their debt. They constantly search for the answer for how to make money in Forex fast.

You have to accumulate a handsome amount of money which you can afford to lose yourself. Don’t borrow money from your friends or family members to trade forex and make a living. Trade with your money. If you don’t have your own money, then don’t trade. Rather wait to earn capital by yourself and then come to this business. Remember, you can’t overcome your debt by trading if you are a new trader.

And don’t try to start trading all currency pairs with just 100 dollars. The low amount is another cause of losing money. Don’t you ever ask yourself why retail traders consistently lose money and why experienced traders and big banks, giant hedge funds lose? Because they have a healthy balance. Balance is a crucial factor in the forex trading platform.

As Forex maker is an enormous market, the size is considerable here so that you could lose all your money just with a strong move in the market.

Misguided trader and wrong informed trader

Most of the time, individual investors hope too much. They are misguided by the so-called forex gurus. Newcomers take this highly speculated market as the billion-dollar incoming market within a short period. Although making millions and billions from the forex market is possible, it takes time, discipline. If you are an indiscipline trader, trade here and there randomly, and consider this forex market as a get-rich-quick scheme, you are also a misguided wrong informed trader.

In the forex market, you need skill. It would be best if you had discipline, a proper rock-solid strategy. Short-term real trading is for the highly professional trader. Armatures are not perfect for short time frame trading. If you open a 5 minutes chart and sit in front of a computer wishing to make hundreds of thousands of dollars in a single day, you are nothing but prey from big hunters. Remember if you know how to get rich from forex trading strategies then you will not become prey of big boys.

Things follow to make money from Forex

Money management: For making consistent money from Forex, you need to maintain proper and stringent money management rules. For every successful trader, it doesn’t matter whether he is a scalper or day trader or swing trader or position trader, follow proper money management. Money management is a crucial factor in the forex market.

You may make some profit for some days trading randomly, but money management is a must if you wish to make forex day trading as a means of your living.

Now the question is, how can you make a strong money management rule. Always try to take less than 2 % risk on your every trade. This means using a small amount of risk for every individual trader from your whole capital. Thus your entire trading capital will be in a safe hand. I am giving a practical example to make the mathematical terms more lucid to you.

Suppose you have 10,000 us dollars in your account. You have a money management plan that you will use only 2 % percent on every single trade so calculate 2 % of 10,000 is 200. That means you are taking only a 200 dollar risk. Now you are tension-free and can open some other trades also with your 9,800 dollars. This way, if you open 10 trades and win 7 and lose 3 trades, even then, at the end of the day or week, your capital will be grown.

Remember, a loss is a must in this business, and you can’t avoid it. So more strict your money management rules will be more likely that you will beat this market.

Risk reward: try to keep your risk-reward high. If you take the risk of 25 pips, try to get back at least 50 pips from that single trade. That means risk-reward is 1:2. Although 1:2 risk-reward is ideal, some professional analysts make even higher like 1:5/ to 1:6.

But if you get 25 pips risking 50 pips, then that is a negative risk-reward and is not a proper one.no matter how many trades you win at the end of the day, you will lose all your money for sure. Sometimes 1:1 risk-reward is welcome but not recommended.

Practical example: if you have a 1: 2 risk-reward system, then out of 10 trades, if you lose even 6 trades and win 4 only, you can make money. If you lose 1000 dollars on each trade and lose 6,000 dollars but earn 2000 dollars on each trade, then 8000 dollars will come from 4 winning trades. See how beautifully you are making money, even losing most of the trades.

Leverage the main culprit: Leveraging the villain or hero is a double-edged knife. By using leverage, you can make a huge profit and an enormous amount of losses. So be cautious when using leverage. In the USA, most online brokers offer a maximum of 1:50 leverage. Suppose you have 5000 dollars in your account. And your leverage is 1:50

So you can take a position worth 250000 dollars. So if you make a profit, then your gain will be high simultaneously; if you lose, your loss will also be high. Any substantial move can eat up all your account if you use excessive leverage, even if you are the richest forex trader.

How to become a successful forex trader make a living trading forex

The first thing you need to do is develop a solid strategy and then try it time and time again. Try to understand the market closely. Take trading as an art but not rocket science. There are no complex fast rules here. You need to understand the fundamental analysis and technical factors of the market.

Many active traders are making a living trading only Forex. If they can do so, you also can do. But first and foremost, you need to stick with one single strategy. Swing trading analysis techniques are the most profitable strategies. Avoid scalping if you want to succeed in the long run. In this article, I share a swing strategy; just check out that and understand how to sell swing high points and how to buy from swing low points. If you can figure out these market turning points, you will be able to buy at low exchange rates and sell at high prices. Making a living from Forex then just a matter of time for you. Just trade and get paid. Isn’t it fun?

Some common mistakes traders make when trading blocks them from being rich

- Most of the average investor come in this most volatile market holding impractical profit targets.

- Traders jump this market greedily and for quick money. They even have no proper and precise knowledge about how the forex market works. they are unconscious about how speedy, with a single move, they can lose all their money

- Without a plan, you can reach anywhere. If you want to get the shore of success here, you need to make a proper plan.

- They simply focus on the positive signs of the leverage but don’t realize the other side of the coin. Leverage has a negative side also. Hardly any knows this.

- Have no idea about what is money management and risk-reward in Forex

- Don’t have a winning trading strategy.

- In most cases, they cut their profit soon but let their loss run.

- Forex brokers are a great factor if any wish to beat the market. sometimes trader chose the wrong broker and lost money

How to get rich from forex trading strategies -with example

Try to keep your chart clean. The naked chart is the best. Try to read the market. Try to understand the market how financial markets work. That’s it. If you can trade in a naked chart, then the chance is high that you will make a profit from this market.

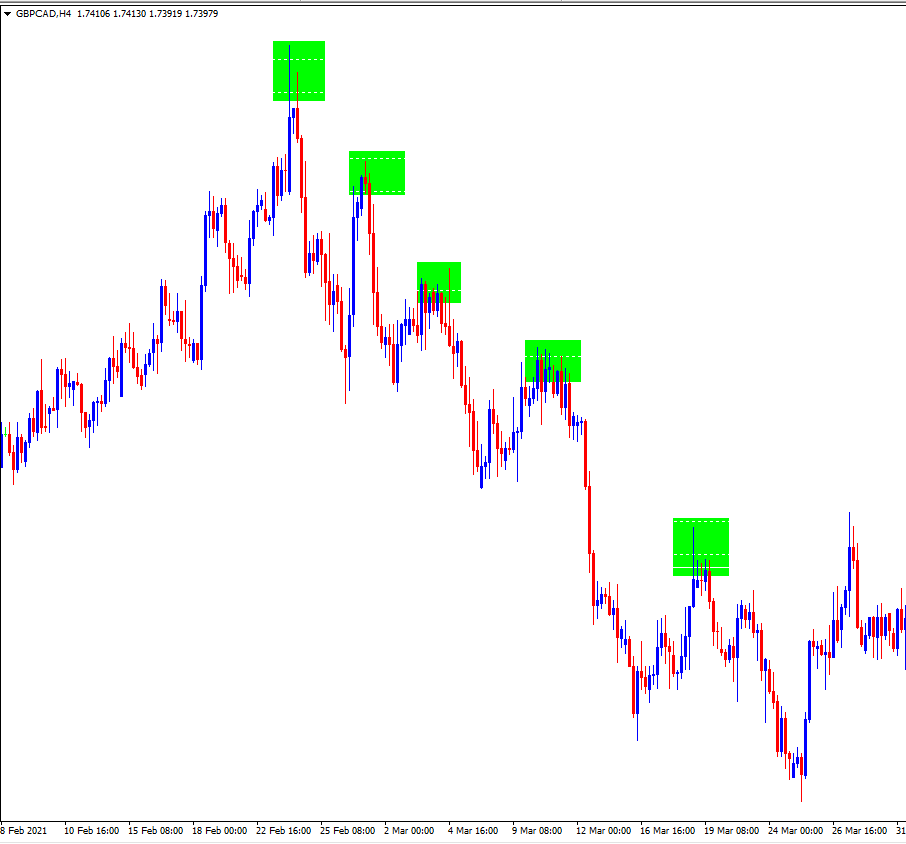

I am giving here an example of naked chart trading. Look at this gbpcad chart. How beautifully every time current market price drops from swing high. Every time the price makes a new swing high and then drops again. If you sell from these points, then every time, you can make a profit and then exit your trade with a profit. You don’t need any indicator. All you need is a solid market understanding.

If you are a newcomer in this market and want to know how to make money on Forex for beginners, then this strategy could be a perfect one. Next time, before searching google how to get rich from forex trading strategies, just stick with this swing trading strategy.

How to make money in Forex without actually trading

Many get crazy making money without investment and search on google “how to make money on forex without trading.” Yes, it’s possible. You know about trading; then, you can earn money by writing blogs on Forex. Some traders are making money by making Forex-related videos. These videos have thousands and millions of YouTube views. You also can work taking ib from any broker. This means you can join any reputed brokers affiliated program and promote them. If you have a fan following then, your fellow traders will deposit in those brokers, and when they trade, you will also get paid a certain amount of money. You also can start coaching and teach people about trading, how and when to open trade & which currency pair is the best.

These are some ways you can also make money from trading without actually trading.

Final Talk

Find the best broker out there in the market, use low leverage, use stop loss in every trade and let your profit run for a long time. It doesn’t matter how many odds are against you. At the end of the day, you will also be a successful forex trader. This piece of content “How to get rich from forex trading strategies” has discussed some hidden aspects of trading. Utilize these tips and tricks to shine your trading experience!

Professional trader’s opinion about getting rich trading forex

” Forex trading may make you rich if you are a hedge fund with deep pockets “

Thomas Brock

” The facts state 95% of traders lose money quickly.”

Monica Hendrix

” There are many forex investors, few are truly successful ones “

Justinas Baltrusaitis

” The simple answer is yes you can get rich in forex, but the reality is that it depends “

Dwayne Buzzell

Some get rich quick strategies

- Why Banks & Hedge Funds Use 200 Day Moving Average : You will know why and how bank and hedge fund traders use 200 moving average to protect their capital and gradually grow their capital.

- Fibonacci Retracement Levels Details : This strategy discussed Fibo retracements level and how to use them in trading effectively.

- If You Don’t Trade Using Rsi Divergence Now, You’ll Hate Yourself Later : RSi divergence is a powerful default indicator to make you rich through trading.

- Who Else Wants to Know How Much Do Forex Traders Make : Here not only will you get a strategy, but you will also know how much successful traders make through trading.

- Ultimate guide to Higher High Lower Low Trading Strategy : Swing points are the points or zones where most of the opportunities lie.

- Little Known Ways to Mechanical Rules for Trading : Remember who succeed in trading follow the mechanical rules of trading.

- Who Else Wants Candlestick Bible Pdf Free : To get success in forex, you must know the basics of candlesticks. Here you get a rock-solid candlestick strategy and a pdf book completely free!

I read this post completely regarding the

difference of most

up-to-date and preceding technologies, It’s amazing article.

many many thanks . keep reading the blog. you will learn many new things