Are you searching for practical and suitable trading tips and tricks ? Then you have pertained to the best place! With over fifteen years of experience in the monetary markets, I will inform you of my 9 best trading pointers for beginners in the following texts. Understanding is power in stock market & forex trading, putting you several steps ahead of other traders.

1. Use the financial calendar and news

The first trading tip is using the economic calendar and the news. The Economic Calendar is an essential tool for any trader. Economic news constantly affects marketplaces, whether you are a short-term day trader or a long-lasting swing trader. Many giant sites like forexfactory, dailyfx ,The Investing have economic calendar. The Economic calendar reveals upcoming news and previous news. It will release the exact period when the news will be released. This information can stem various trading strategies.

For example take a look at the economic calendar of forex factory

In the picture above, you can see an area of the economic calendar. The strength of the news is indicated by the “colour”. From my experience, you shouldn’t trade on the news with “red color”. The volatility is simply way expensive, and the liquidity is too low. Risk-seeking traders can open a speculative trade right after the publication. I strongly advise every trader to check this economic calendar before trading. There can be really strong movements in the market after the news. From my experience, it does not make much sense to trade this news as the relocation are unpredictable in most cases.

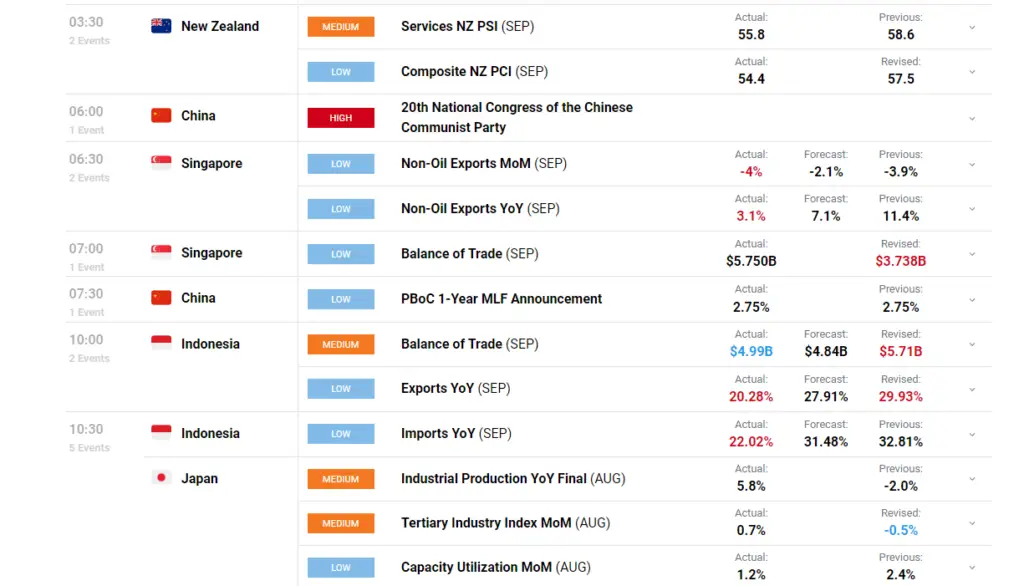

Here I am giving another example of dailyfx economic calendar.

Here, you need not worry about which one is most important and which one is less critical. Because here you will see high, medium, and low-impact news. All are written there.

Some other good sites have financial calendars & publish news regularly

- Fxstreet economic calendar

- Babypips economic Calendar

- Investing.com economic calendar

- Myfxbook economic calendar

- Forex.com economic calendar

- Forexlive economic calendar

High volatility and low liquidity make it unsafe to trade. You can get different trading strategies from these news release. Do your research study before you trade.

2. Practice in the demo account

The trading demo account is extremely essential for novices and advanced traders to test trading platforms, strategies, and so on. It is a virtual funds account that mimics real money trading. I strongly advise practising with the demo account initially up until you trade profitably and feel really confident. You can open a demo account with any broker.

My recommendations is to stick to these renowned brokers to practice demo. These brokers will not only give you the best platforms to practice yourself but also provide many essential trading tips and tricks to shine your skill perfectly.

- Interactive Brokers

- IG

- Dukascopy

- Saxo Bank

- Blueberry Markets

- Tickmill

- eToro

- Alpari

- FOREX.com

- FXCC

Famous trading analyst Will Kenton once said that, demo accounts could help experienced traders test new strategies.

The trading demo account is an account with virtual funds. Genuine money trading is simulated with play money. Beginners ought to practice trading with it.

3. Choose a reputable broker

The broker ought to be reputable. Due to the excess of choices, it is hard for a newbie to decide which broker is really excellent. Above you will find the top ten brokers list. Which are the most inexpensive and reputable forex brokers on the planet. This is arguably the most cost effective trading tip for the trader. In more than 15 years of experience I have actually tested numerous brokers. Trading charges can accumulate for many years, so be sure to search for an inexpensive broker. Alone with a conserving of 1 EUR per opening of the Oder, a very large amount is computed over the year.

What are the characteristics of a good broker?

- Regulation and Licensing

- Free demo account

- Low trading fees

- No hidden costs

- Fast execution

- Professional German customer support

- Whether it shares trading tips and tricks or not

4. Keep learning

Detail understanding and knowledge about the forex and stock market make you a successful trader. From my experience, there is a problem here that numerous novices with little knowledge want to begin trading. Trading needs to be constructed from the start like a structure. You should start with absolute standard knowledge. For example, many brokers provide webinars, training, books, and more to discover how to trade. This is an excellent way to refresh your understanding. There are also other books on Amazon or YouTube videos for innovative knowledge.

Before jump into the live trading ask yourself these questions

- How does order execution work?

- How much money do I wish to run the risk of?

- Is there any strong news coming soon that will impact my market?

- What trading method am I following?

- What is my loss limitation?

- What is my trade goal?

- Do I follow the trading tips and tricks I learned from the top-level analysts and mentors?

5. Try to avoid stress and emotions

Lots of individuals are emotionally controlled. In stock & forex trading, you have to take it as a threat in order to make a good profit at all. The body must be rested since one requires a complete focus on the trade. The smartphone device or messages can distract the trader when trading. Trading is about making cash, and every trader wants to get the most out of it.

Numerous traders discover it hard to switch off after several losses. They keep trading after that and make more errors through emotions. You have to learn to turn it off. Make sure to set yourself a loss limitation. A loss limit avoids the worst wrong choices and feelings. Numerous traders start trading despite their poor physical condition.

For instance, you need to not trade if you are ill or stressed. From my experience, it makes very little sense to take a seat at the computer system after a fight with your girlfriend and start trading on the stock market.

Trade if you are in good physical condition Set a loss limit to prevent emotional trading

6. Create your own trading strategy, Trading tips and tricks and stick to it

There are millions of stock market and forex trading strategies that work. The biggest mistake traders make is not following these trading strategies consistently. You must execute the strategy step by step to get a good result. You need to act almost like a machine and implement the rules.

A set of rules is crucial for stock exchange and forex trading. It describes the principles of trading strategy. Without a set of rules, the trader will fail miserably. From my experience, I can say that my performance is significantly better when I trade a strategy according to a fixed set of rules.

Fibonacci strategy

Support and resistance strategy

You can create the set of rules yourself. But for this, you need experience and knowledge, which you acquire over an extended period. In the demo account, backtests can be carried out in trading. Creating a strategy and set of rules takes a lot of time. But it will help you significantly in trading.

Test different trading strategies Execute these strategies strictly by the rules Develop your own set of rules for trading

7. Follow money management rules

As mentioned above, trading is risky and requires the use of capital. The higher the risk, the higher the profit can be. The risk must be planned before each trade and is delimited by the stop loss .

In trading, several losses in a row are part of it. Therefore, you should use sensible risk management to avoid damaging your trading account too much. For example, if you bet 20% of total capital per trade, after 3 losing trades, your account will be almost 60% smaller. This doesn’t really make sense, and you will quickly destroy your account. There are also emotions because the sums involved are too high.

Professional traders risk 0.5 – 2% of their trading account per trade. This is a very good value, with which you can protect yourself against fluctuations. Would you rather gamble or increase capital quietly and in the long term? – This is your decision.

“to successfully manage money in forex, use an optimal risk-reward ratio so that you can have a holistic view as to where best the money fits and when is the perfect time to sell out positions.”

Grant Adlington

Risk must be planned before each trade. How much money do you want to risk? Professional traders use only 0.5 - 2% risk of the total account per trade. Too much risk leads to emotions and wrong decisions

8. Use take profit & stop loss

Use the Take Profit and Stop Loss for your trades. Preparation before trading is essential, and that includes these automatic limits. Optionally, the stop loss can also be followed in the profit,; thus, the risk is removed from the market.

The Take Profit and Stop Loss are automatic limits that close the position at your fixed price. This happens in the event of a win or in the event of a loss. The stop loss is the most important tool for a trader to hedge risk. Trading without a stop loss is not recommended and can lead to high capital losses.

You can optionally change these two limits after you open the position . In summary, the take profit and the stop loss are the most important means of securing your profits and limiting losses.

9. Take a look at the market volatility

As a trader, you must know the market properly. You can trade some markets digitally 24 hours a day. Stock & Forex market hours play a considerable role in trading. Volatility and liquidity boost throughout market opening hours. It would be best if you certainly took note of this.

When should you open the trade?

Only the official opening hours of the stock exchange and volatile sessions like London and new York sessions make sense for day trading. You will see a clear difference between day and night. In addition, the volatility is significantly higher for stock trading when the stock market opens. You should also be prepared for this.

For example, it does not make sense to make a quick trade on Friday evening. The movements are barely noticeable, and many traders have already gone into the weekend. You will obtain the best results during the official trading hours. Some markets cannot be traded at night, either. Positions can, therefore, not be opened or closed.

In forex, London and new york are volatile sessions. But the overlap of two volatile sessions would be best for getting the best setups. The most volatile session in forex is the London-New York overlap. Stock market openings cause high volume and volatility It makes little sense to trade outside of opening hours

Final Talk

All the 9 trading tips and tricks are part of a successful trade, and you should not avoid any of the above. In my 15 years of experience in the financial markets, I have made quite a few mistakes. So decided to spread my teachings to make it easier for beginners to start trading.