Those who are the top participants in the market create forex market structures. If you wish to know the market structure of forex, then you must have to know the structure of the stock market as the stock market is very similar to the forex market. The only difference is the stock market is a centralized market where the forex market is decentralized. in the stock market, one entity controls the whole stock market where no one controls the foreign exchange market.

If you want to trade stock, then you need to go through any stock exchange like the new york stock exchange or London stock exchange, but for trading forex, you don’t need to go to any stock exchange house.

Seemingly this might be awkward, but this very nature of the forex market conditions makes it such awesome. The forex market is so huge that you will get the best dealing price at every single moment. You can trade forex anytime and anywhere.

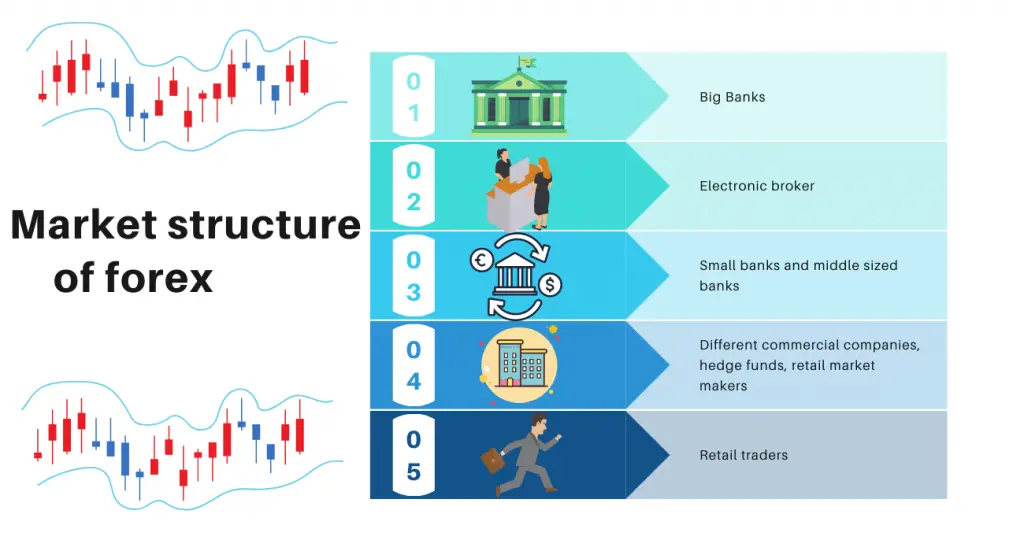

Market structure of forex-ladder

Take a look at the forex market ladder. At the very top of the ladder, there are big banks. These big banks trade directly with each other through electronic brokers or bilaterally. Big banks are always in a battle for hunting clients. All the banks of the interbank market always watch the rates which they offer.

The second step of the ladder is the EBS platform. EURUSD, USDJPY, EURJPY, EURCHF, and USDCHF are the most liquid pair. The third step of the ladder is small banks. Small banks and middle-sized banks are also a crucial part of the currency market. The next step of the ladder is different commercial companies, hedge funds, and retail market makers. As these institutions have no or little relationships of credit with each other, so they need to rely on big commercial banks for their transactions happening.

What does it mean? this means the rates of these hedge funds and retail Market makers are slightly high than the big commercial banks. Last but not least, at the very bottom of the ladder, retail forex traders stand.

List of participants of Market structure of forex

- Big Banks and central banks like Bank of England and The Federal Reserve System or central bank of the United States (FED)

- Electronic broker like eToro

- Small sized banks Deutsche Bank

- Different comercial companies & Hedge funds and Retail market makers like JP Morgan

- Retail Traders

We should be very grateful to the internet and electronic trading as if these modern technologies were not available, then we, the retail traders, could not be able to trade with such a tiny amount of money. Retail brokers help us in these fields. The various retail brokers have wiped out all the obstacles of retail traders to execute a trade, even sitting at their home in front of the personal computer.

How to read forex market structure

Bullish market structure

When higher highs and higher lows happen in a series, that is a bullish market structure. You can define the market as bullish until you find any lower low.

Bearish market structure

When lower lows and lower highs happen in a series, that is a bearish market structure. Until you find any higher high, you can define the market as a bearish market.

Sideways market structure

When equal highs and equal lows continues that is called sideways market.

How to trade reading market structure of forex

Although different traders read market structure differently, the most effective way is to find the best profitable setups in the market turning points. In a bullish market, place a buy trade when the price breaks the previous higher high. Although this is an aggressive entry, you will usually see your trades go profit. But some traders place buy trades on higher lows. Placing trades on higher lows is a conservative entry, but often you will see that price won’t go your way, and you could make losses.

In a bearish market place sell trade when the price breaks the previous lower low. Although this is an aggressive entry, you will most of the time see your trades profit. But some traders place sell trades on lower highs. Placing trades on a lower high is a conservative entry, but you will often see that price won’t go your way, and you could make losses.

Trading in a sideway market is easy. Every time it touches an equivalent low area place, buy trade, and every time it touches an equivalent high area place, sell trade.

Best strategies to trade according to market structure

- Cup and handle pattern vs Double top pattern

- Why Banks & Hedge Funds Use 200 Day Moving Average

- The Secret of triple moving average crossover strategy

- 9 ema and 20 ema Forex Strategy for 2022

- 5-8-13 Combination: The best moving average for day trading

- 13 elliott wave patterns pdf

- Little Known Ways of Using Awesome Oscillator Indicator

Professional trader’s opinion about market structure of forex

” Market structure by definition is the simplest form of price movement in the market “

Victorio Stefanov